50 Joint And Survivor Annuity

You might be able to choose either a 100 75 or 50 percent joint-and.

50 joint and survivor annuity. If Sara chooses the 50 joint-and-survivor annuity she will receive 1560 per month as long as she lives. A 50 Joint and Survivor Annuity is a reduced monthly pension for the life of the Participant and upon his death his surviving Spouse shall receive a reduced lifetime benefit equal to fifty percent 50 of the benefit that the Participant had been receiving commencing on the first day of the month following the date of the Participants death. If your Joint Annuitant dies before you you continue to receive the same amount and when you die the benefit stops.

The survivor annuity must be 50 -100 percent of the annuity payable during the participant and spouses joint lives and must be the actuarial equivalent of a single annuity. A QJSA is when retirement benefits are paid as a life annuity a series of payments usually monthly for life to the participant and a survivor annuity over the life of the participants surviving spouse or a former spouse child or dependent who must be treated as a surviving spouse under a QDRO following the participants death. The most common and popular types of Joint and Survivor Annuity are a joint one-half annuity and a joint two-thirds annuity.

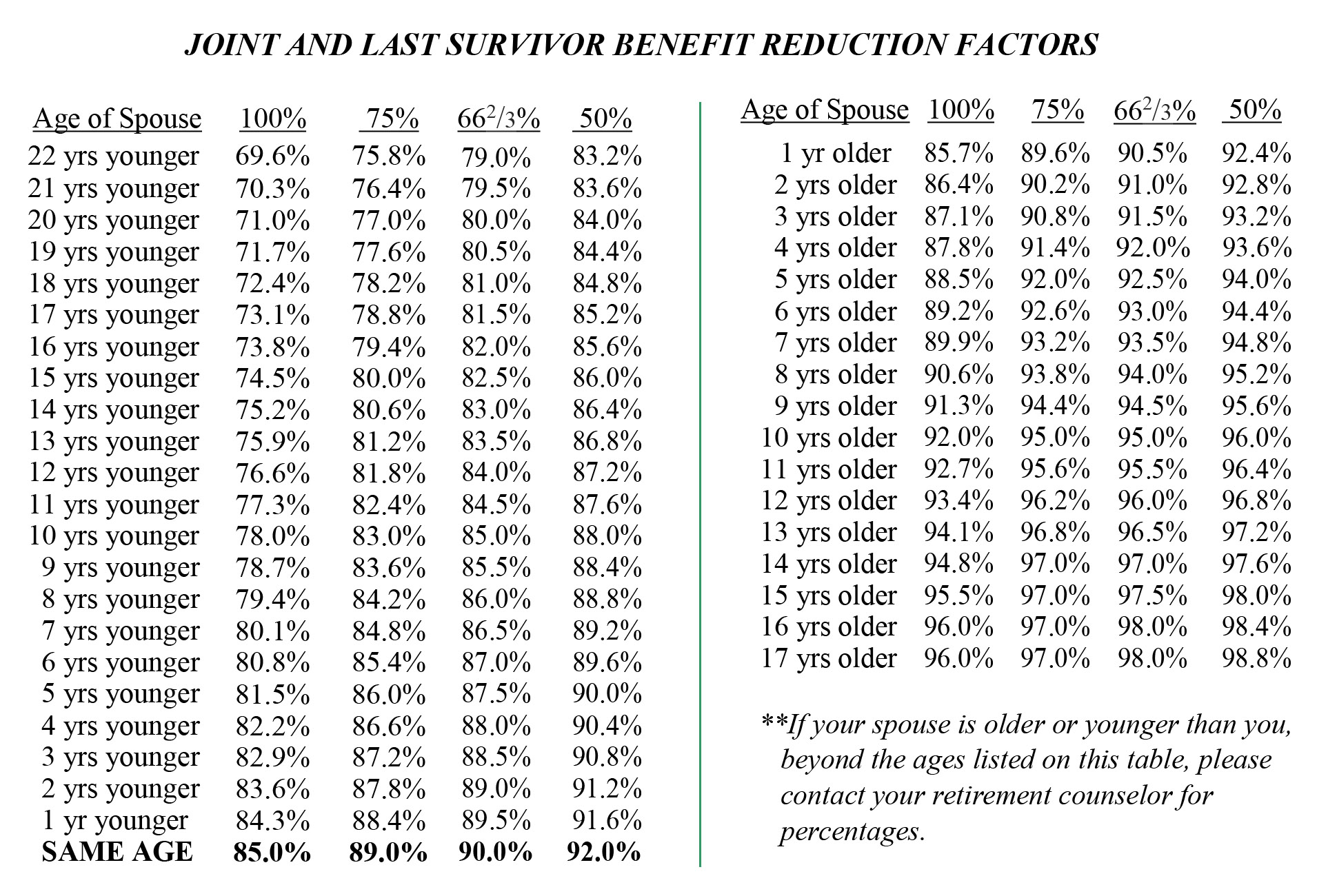

The survivor benefit can be 100 75 66 or 50. If you die before your designated beneficiary monthly payments of half the amount you received prior to death will be paid to the beneficiary for the rest of his or her life. Depending on the contract the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

To accommodate different circumstances many plans offer alternative levels of survivor protection. You designate a beneficiary called a Joint Annuitant when you apply for retirement with the Pension Plan. A joint and survivor annuity also known as a joint-life annuity is an insurance product for couples that continues to make regular payments as long as one spouse lives.

Upon her death her spouse would receive half that amount780 per. You get a reduced monthly benefit for your lifetime. 50 Joint and Survivor Annuity Youll receive the same monthly pension as long as you live.

Joint two-thirds annuity In this type of Joint. Joint and Survivor Annuity Disadvantages. They can elect to change the size of the payment to the surviving annuitant when one of them passes away.