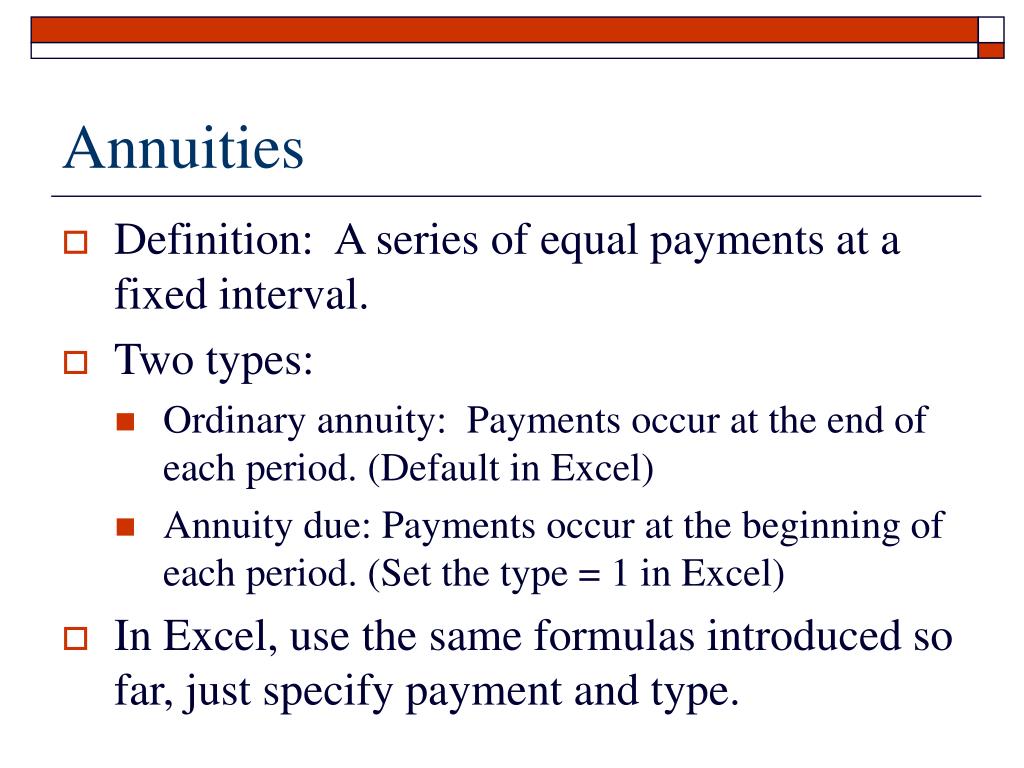

Annuity Due Definition

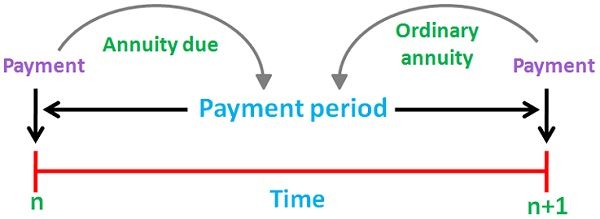

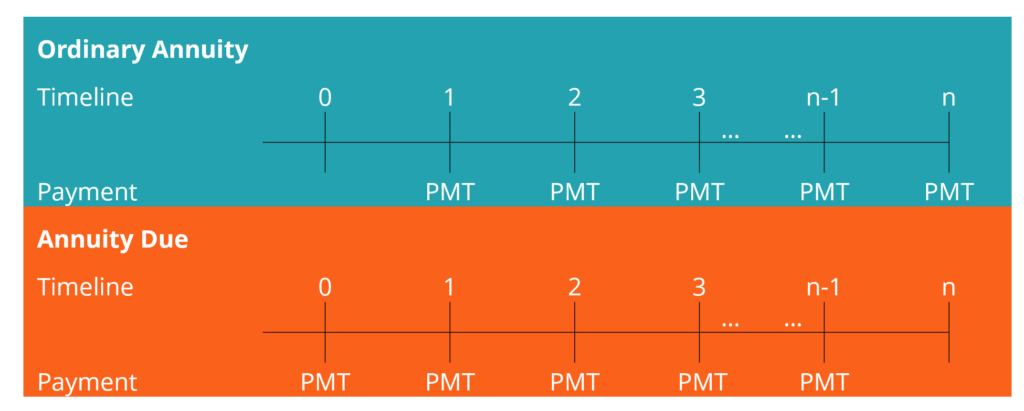

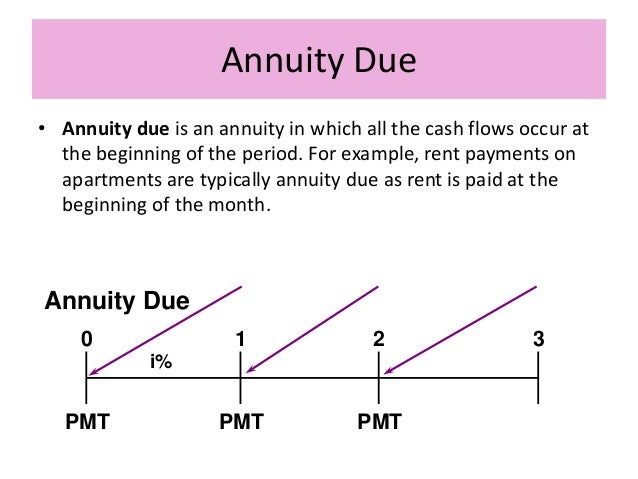

With an annuity due the payment or receipt of money occurs at the beginning of each interval.

Annuity due definition. To understand the present value of an annuity due you. Deposits in savings rent or lease payments and insurance premiums are examples of annuities due. Annuity due refers to a series of equal payments made at the same interval at the beginning of each period.

Definition of Annuity Due. A common example of an annuity due payment is rent paid at the beginning of each month. The term annuity due refers to a series of payments or receipts of money occurring at consistent intervals of time with an interest charge applied once per interval.

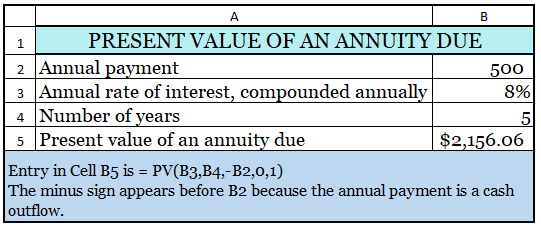

Present Value of an Annuity Due. Many lease agreements have annuity due payments while credit cards for example do not. The higher the discount rate the lower the present value of the annuity.

Annuity due is an annuity whose payment is due right now at the beginning of each period. Periods can be monthly quarterly semi-annually annually or any other defined period. An annuity due is sometimes referred to as an immediate annuity.

An example would be the monthly rent on an apartment. Annuity refers to the level of an equal periodic stream of cash flows over a specified period of time both cash inflows and cash outflows. An annuity due is an annuity that is offered by many life insurance companies.

This formula can only be used in cases where the presentvalue of an investment is known. An annuity due is a repeating payment that is made at the beginning of each period such as a rent payment. The payments from the annuity are distributed at the beginning of each period.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

:max_bytes(150000):strip_icc()/FVAnnuityDueCalculation1-4d12243b371244199e020426d698a592.jpg)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)