Annuity Surrender Charge

After the surrender period ends the surrender charge goes away.

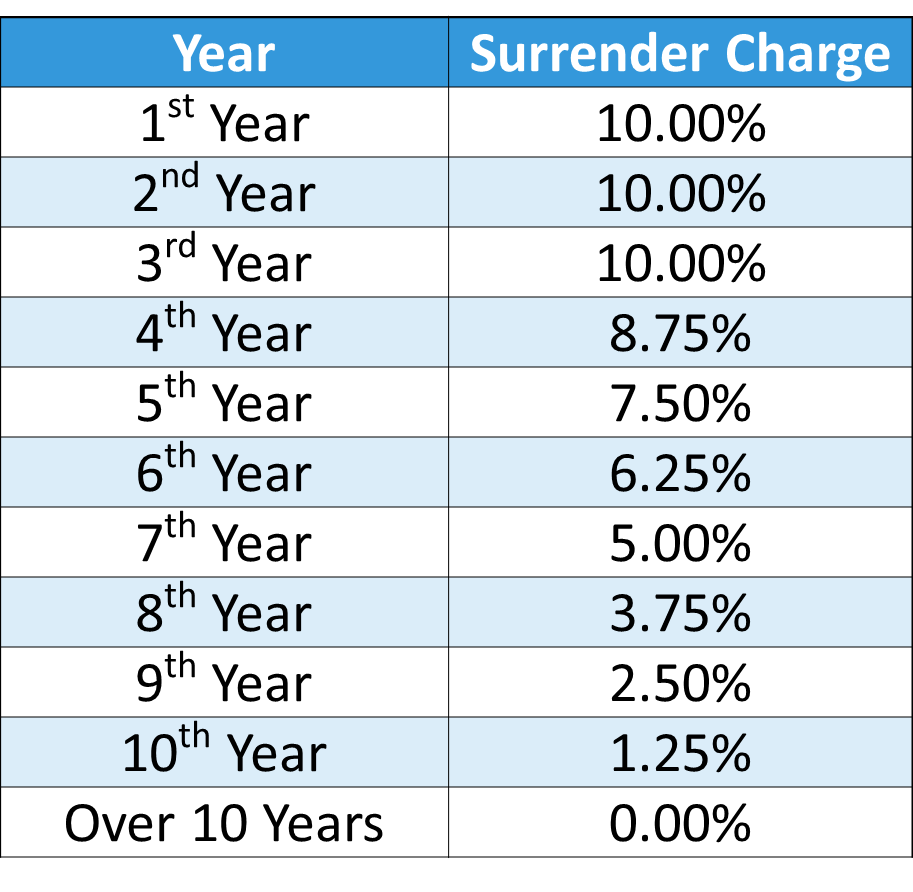

Annuity surrender charge. Annuity surrender charges are the fees that insurance companies collect when an annuity owner withdraws money during the surrender period. However unlike our car example with annuities all of the trade-in penalties are detailed in the contract so owners know exactly what any early excess withdrawals will cost them. Some bonus annuities and equity indexed annuities come with surrender charges in excess of 10 and surrender periods longer than ten years.

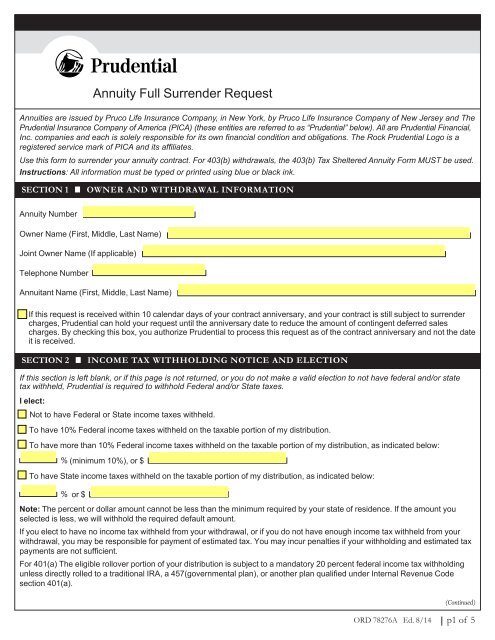

Annuities typically have surrender periods where early or excessive withdrawals may result in a surrender cost. It is common for this fee to decrease over the life of your annuity. A surrender charge is a fee that you have to pay when you cancel your life insurance or annuity which is known in the business as surrendering your policy.

It is common for this fee to decrease over the life of your annuity. Withdrawals During the Surrender Period If you take money out of an annuity you may face a penalty or a surrender fee also known as a withdrawal or surrender charge. Sometimes for certain kinds of variable annuities this kind of fee is also called a contingent deferred sales charge or CDSC for short.

This surrender charge percentage will typically decrease over a seven to ten year period. Annuity surrender charges create similar results when the annuity is prematurely surrendered. Surrender charges are also referred to as surrender fees and early withdrawal fees.

That was a mouthful. Surrender charges for annuities are the penalty a contract owner will receive if they surrender cancel their deferred annuity contract before the agreed surrender charge period or withdraw a portion of their account balance above their allotted penalty-free withdrawal amount. The shorter time period one holds the annuity the larger the penalty.

This surrender charge percentage will typically decrease over a seven to ten year period and. Typically this surrender charge is a percentage of the amount withdrawn and decreases over a seven- to ten-year period. To put it simply annuity surrender charges are penalty fees that will be deducted from your account balance if you choose to cancel your contract close your account before a pre-determined number of years have elapsed.