Annuity Tax Rules

You dont have to worry about paying tax.

Annuity tax rules. Note that annuity payments count as ordinary income which is generally speaking not a favorable capital gains rate. Annuity Taxation Annuity Tax Rules and Information. The NAICs Suitability in Annuity Transactions Model Regulation governs when a sales representative can recommend purchasing an annuity.

Any money you take out before age 59½ will also be subject to a 10 early. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Generally pension and annuity payments are subject to Federal income tax withholding.

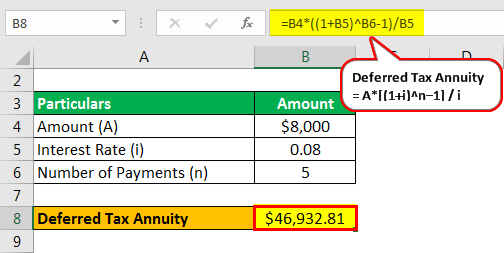

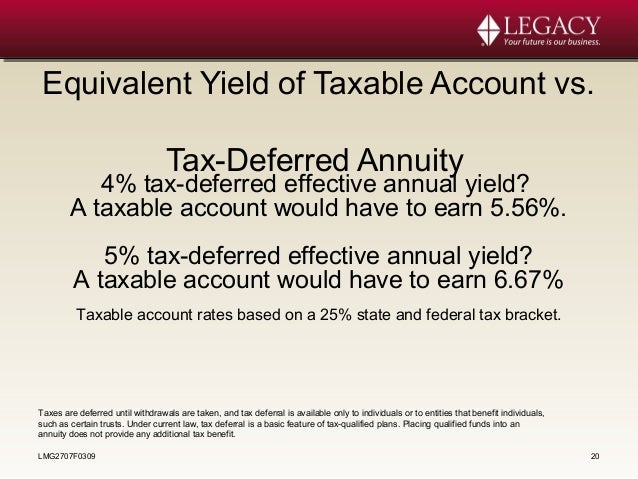

Variable annuities - make payments to an annuitant varying in amount for a definite length of time or for life. As long as your money remains invested in the annuity contract you dont have to pay any taxes on any income or gains that the annuity produces. The primary rule for taxing non-qualified immediate annuity payments or non-qualified deferred annuities which are distributed in installment payments ieannuitized is designed to return the owner-purchasers annuity investment in equal tax-free amounts over.

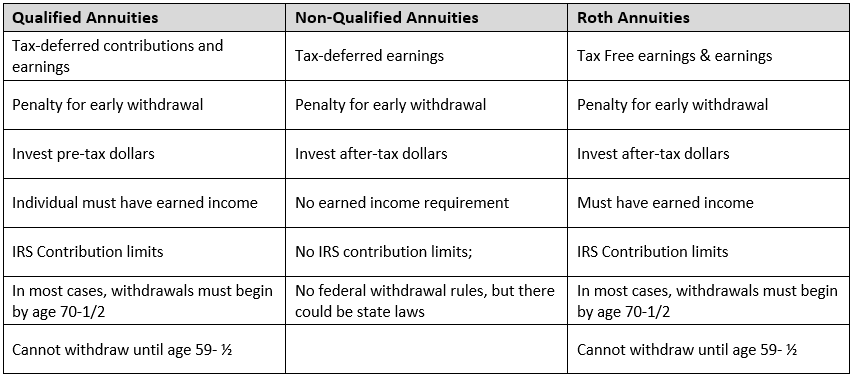

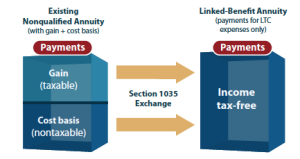

Non-qualified annuity premiums are not deductible from gross income. So if you wrote a check from your taxable bank or brokerage account to pay the premium for the annuity its a non-qualified annuity. A non-qualified annuity is purchased with after-tax dollars that were not from a tax-favored retirement plan.

The amounts paid may depend on variables such as profits earned by the pension or annuity funds or by cost-of-living indexes. The regulation according to the association is designed to ensure the insurance needs and financial objectives of consumers are. You can buy an annuity with funds in your IRA and if you use pretax money from an IRA or a 401 k to purchase the.

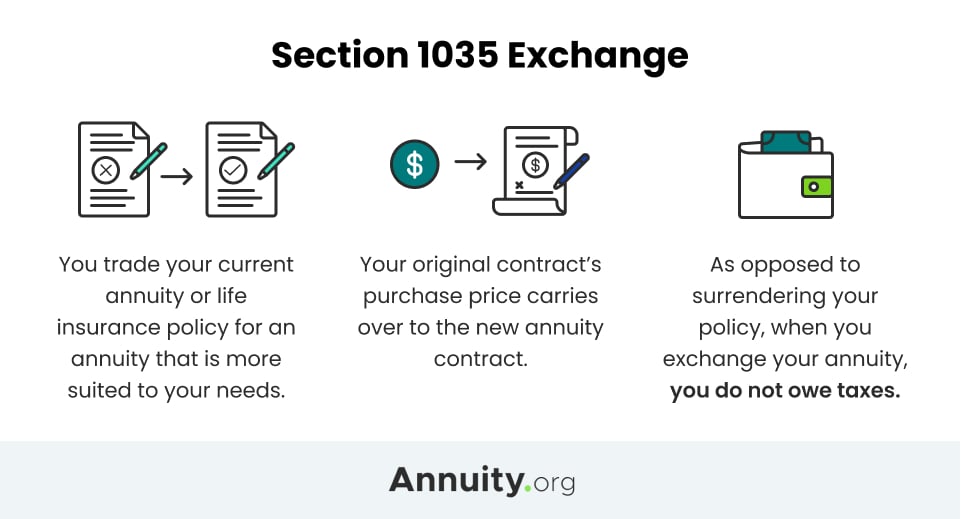

Tax deferral for annuity money Once the money is in the annuity though it gets the same tax deferral that IRA and 401 k money gets. You will pay normal income taxes on any future qualified annuity payments. This section of the tax code includes exceptions specific to certain types of annuity contracts annuity start dates and withdrawals for certain major disasters including among others.