Calculating Annuity Cash Flows

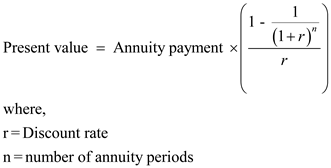

P C 1 1 r-n r Present Value of Annuity at Year 50 10000 1 1 10 -25 10 Present Value of Annuity at Year 50 9077040.

Calculating annuity cash flows. For example youll find that the higher the interest rate the lower the present value because the greater the discounting. What Is An Annuity. If an investment earns an annual interest rate of 6 and returns 5000 per year for a period of 5 years the present value of the investment can be calculated as follows.

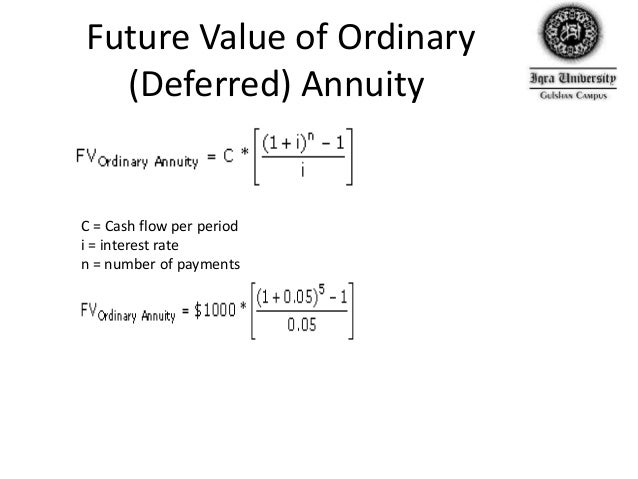

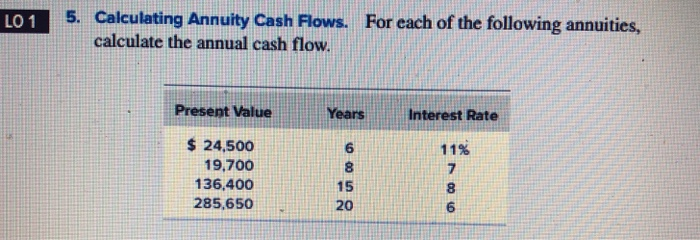

C cash flow per period i interest rate n number of payments beginaligned textFV_textOrdinaryAnnuity textC. Problem 5-5 Calculating Annuity Cash Flows LO 1 For each of the following annuities calculate the annual cash flow. By this definition a mortgage loan contract with specified monthly payments may be called an annuity and a bond purchase that pays interest.

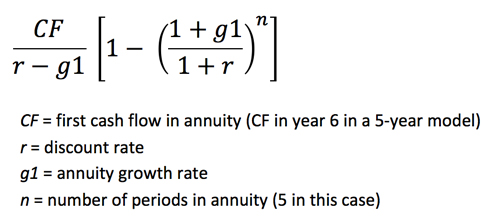

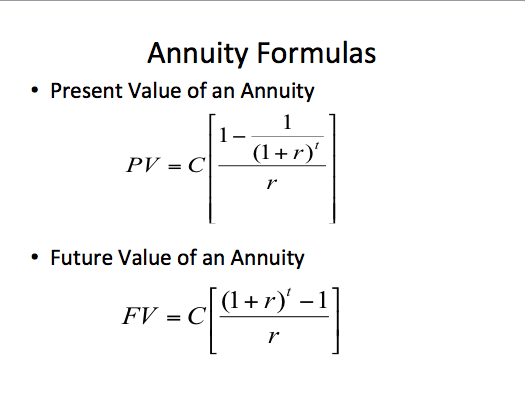

To sum the FV of each cash flow each must be calculated to the same point in the future. If the rate or periodic payment does change then the sum of the future value of each individual cash flow would need to be calculated to determine the future value of the annuity. Calculate the annuity of cash flows by using the following formula.

There are formulas for calculating the FV of an annuity. Divide the future value you want by the future value of an annuity factor. But that value you need at year 50 ie.

Example of Future Value of an Annuity Formula. Present Value of Annuity is calculated using the formula given below. Note that the result from the function is negative representing a cash outflow.

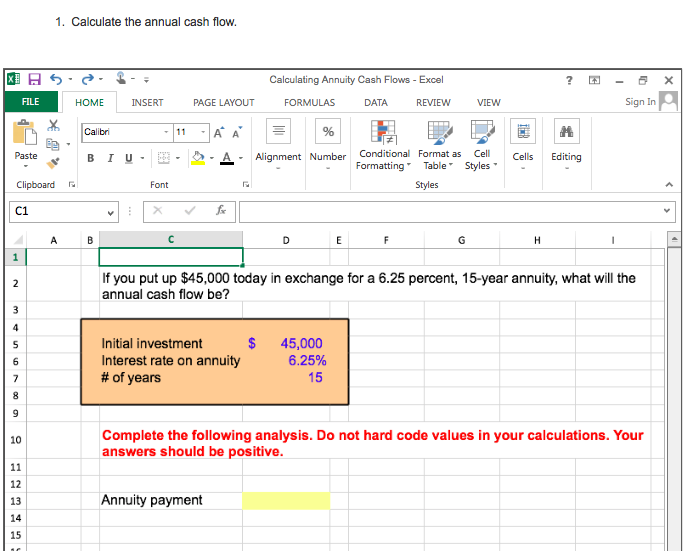

In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of saving for retirement. 20 years from now. Calculating Annuity Cash Flows LO1 If you put up 45000 today in exchange for a 625 percent 15-year annuity what will the annual cash flow be.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)