Charitable Gift Annuity Rates

For more information on the background and the solution we are working on with the New York Department of Financial Services please click here to read more.

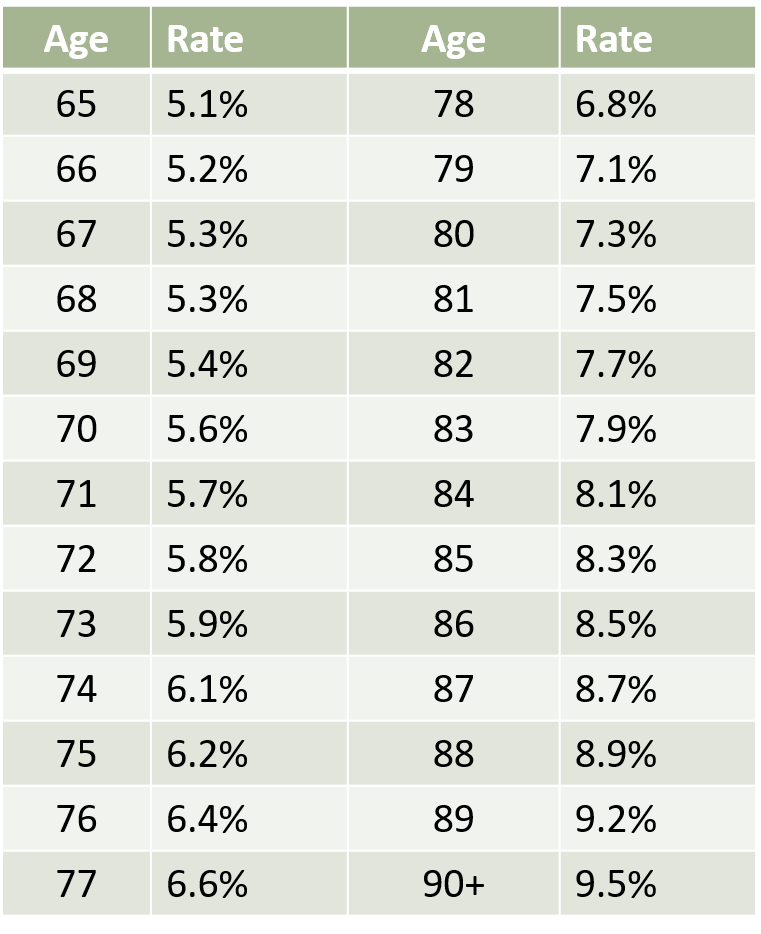

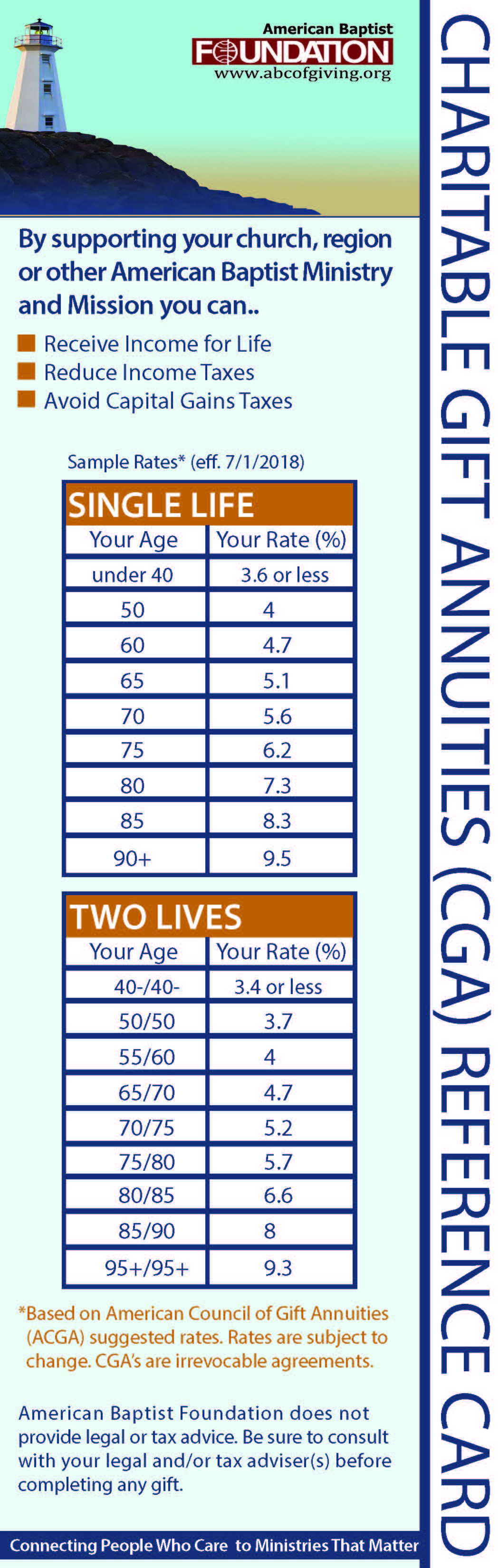

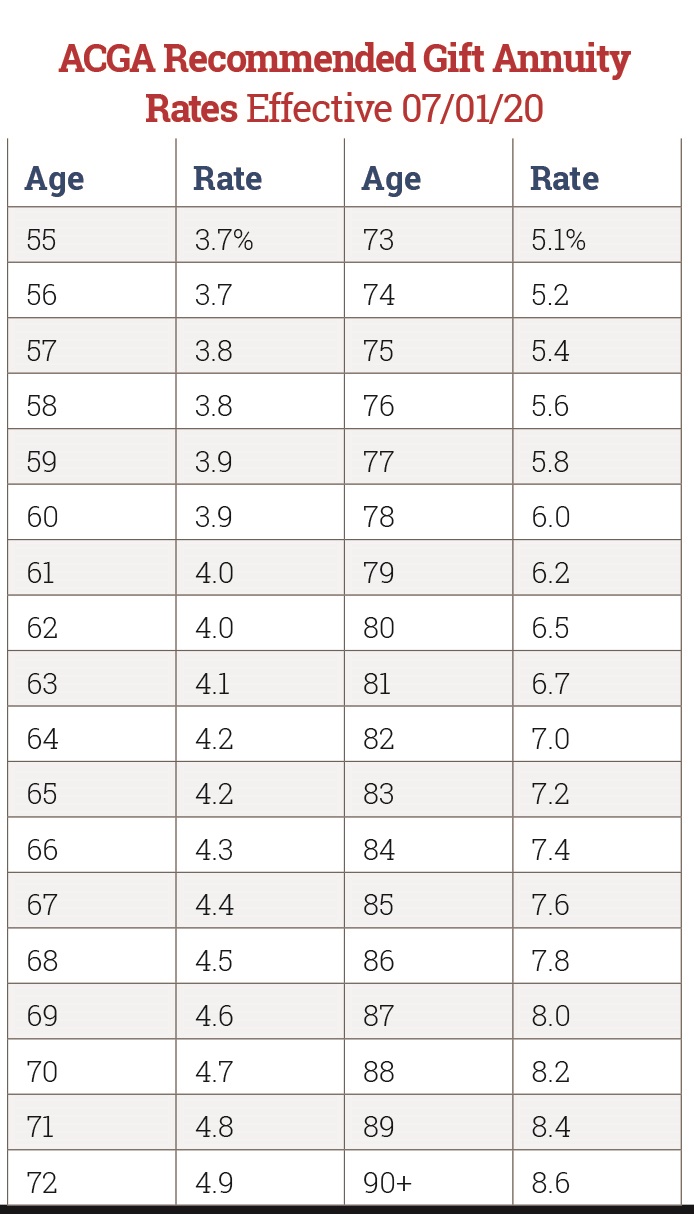

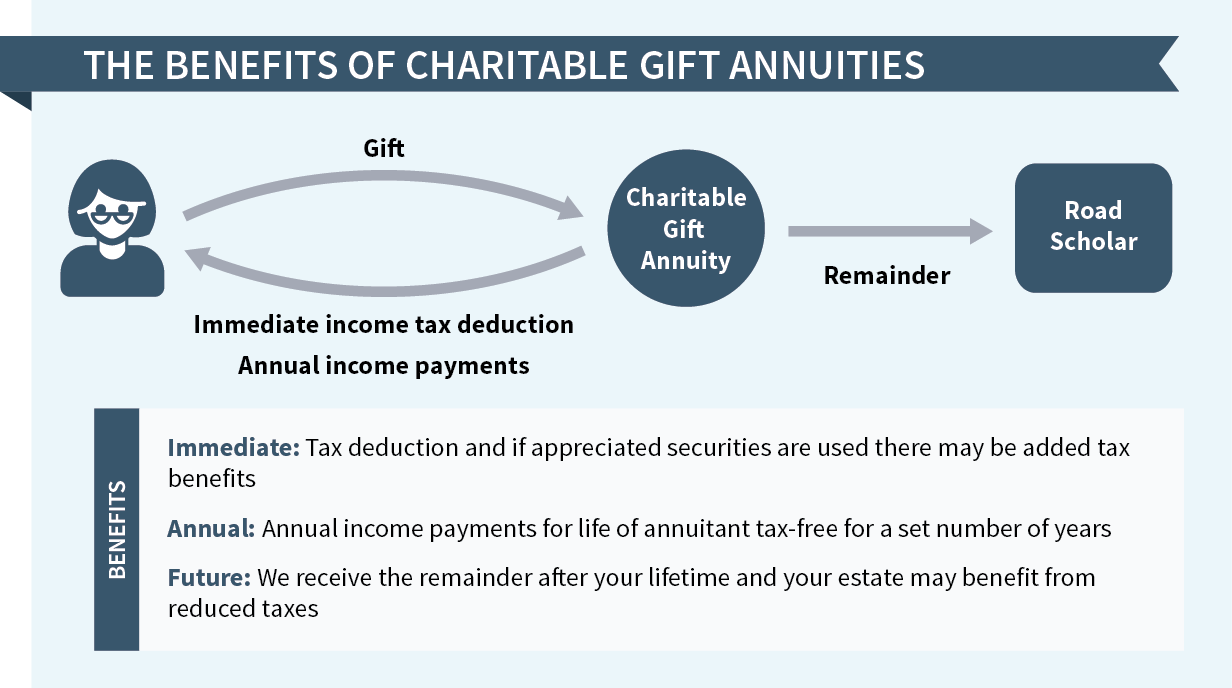

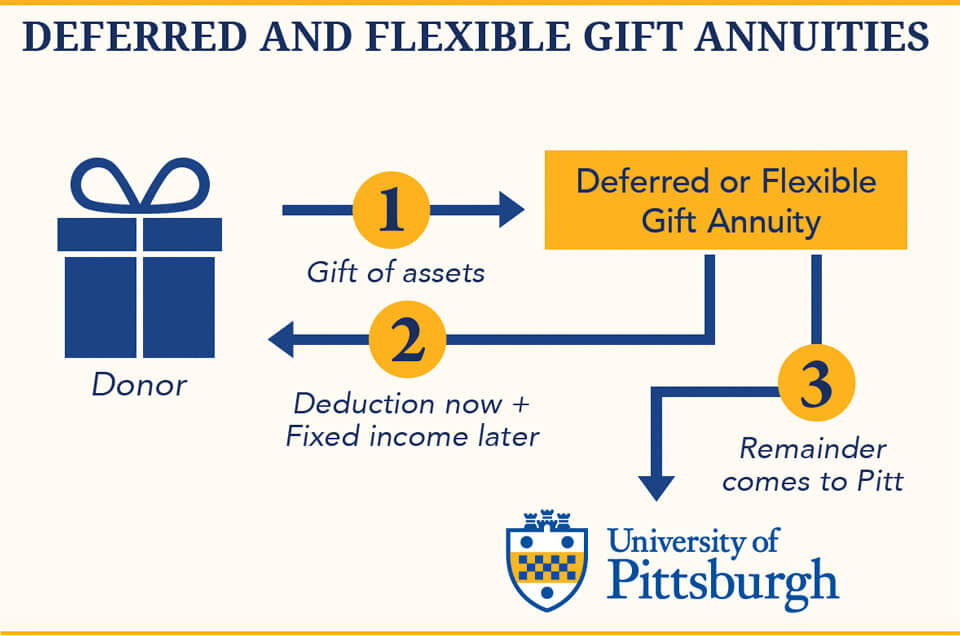

Charitable gift annuity rates. A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return. A charitable gift annuity functions as an exchange of a cash gift for a stream of payments for life. SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021.

Continued Younger Age Older Age Rate Younger Age Older Age Rate Younger Age Older Age Rate 79 83 55 82 85 61 85 87 68 79 84 - 85 56 82 86 - 87 62 85 88 69. Barbara would have received annual payments of 1350 based on a payout rate of 54 percent. Younger donors may often see significantly lower rates based on the longer expected term.

A CGA is one of the easiest forms of planned giving. The American Council on Gift Annuities ACGA is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout rates. Ad Get Annuities Com.

A charitable gift annuity is a contract between you and your alma mater. She will receive annual payments of 1650 a rate of 66. Two Lives Joint Survivor.

Charitable gift annuities can provide a tax deduction. Because they need continuing income they decide to give the cash in exchange for a one-life charitable gift annuity that we will issue at the suggested rate of 54 or 1350 per year. If Mary waits to make her gift after the new rate schedule is in place on July 1 the same gift amount will provide 1550 in annual payments reflecting a 62 rate.

With the new rates. The exact amount of that gift is agreed upon at inception. Any money left in the annuity when you die goes to the charity.