Charitable Lead Annuity Trust

Ways to Gift Meet Our Donors Tools Resources.

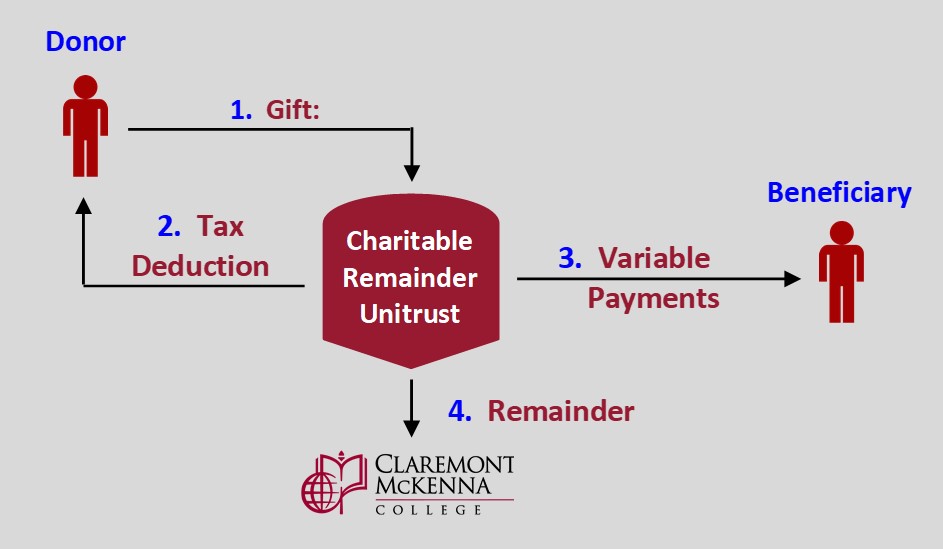

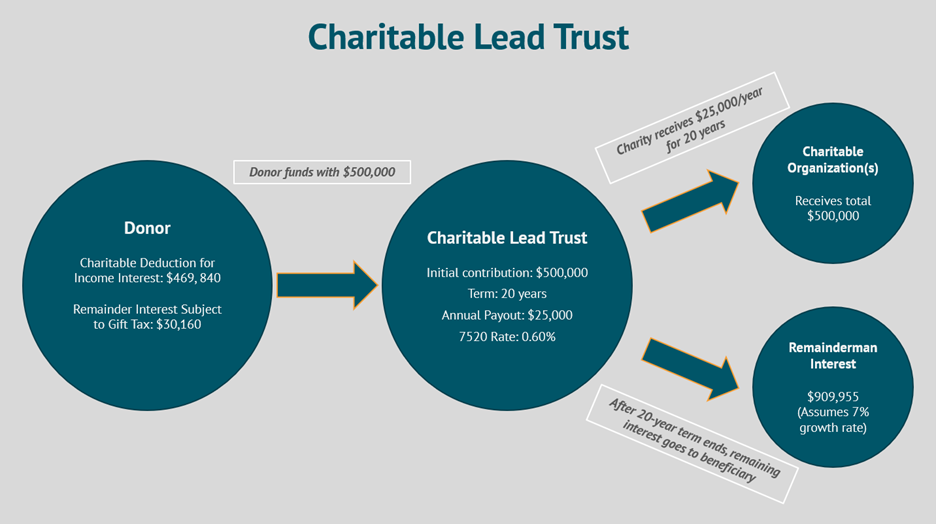

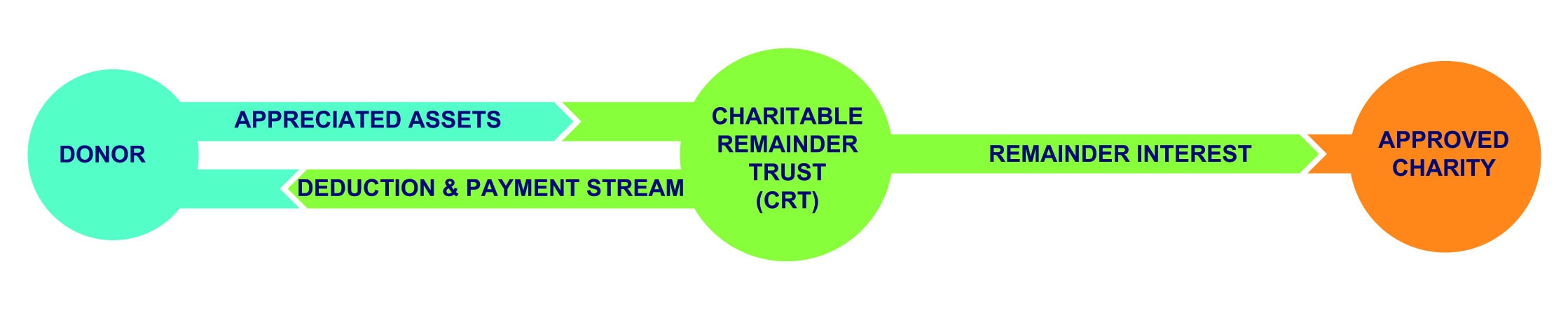

Charitable lead annuity trust. Disadvantages of the CRT are that a trust must be created which isnt cheap and a trustee must manage the trust. Breaking Down Charitable Lead Trust A charitable lead trust. There are two main types of payment terms for Charitable Lead Trusts.

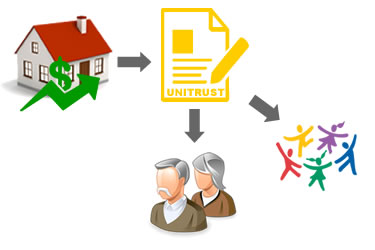

Local Estate Planning or Estate. Wills Trusts and Annuities. In a CLAT the trust pays a uniform payment to the charity.

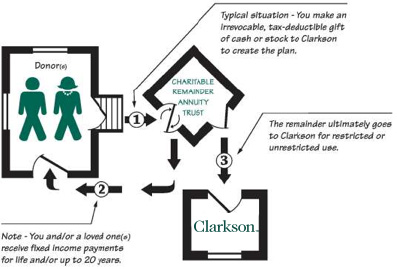

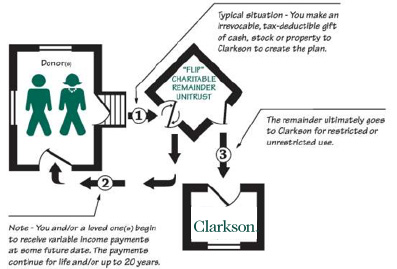

The word lead in charitable lead trust refers to a lead interest in the trust which is the charitys right to receive payments for the trust for the specified term. A CLAT is an irrevocable trust set up by the donor who contributes assets such as cash or marketable securities to the CLAT. But these trusts havent been used much by.

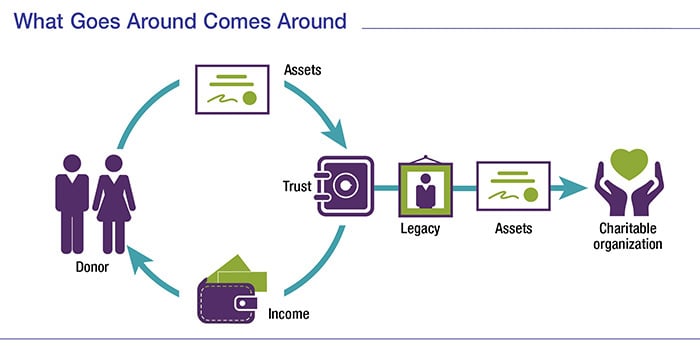

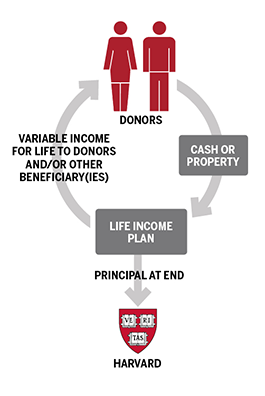

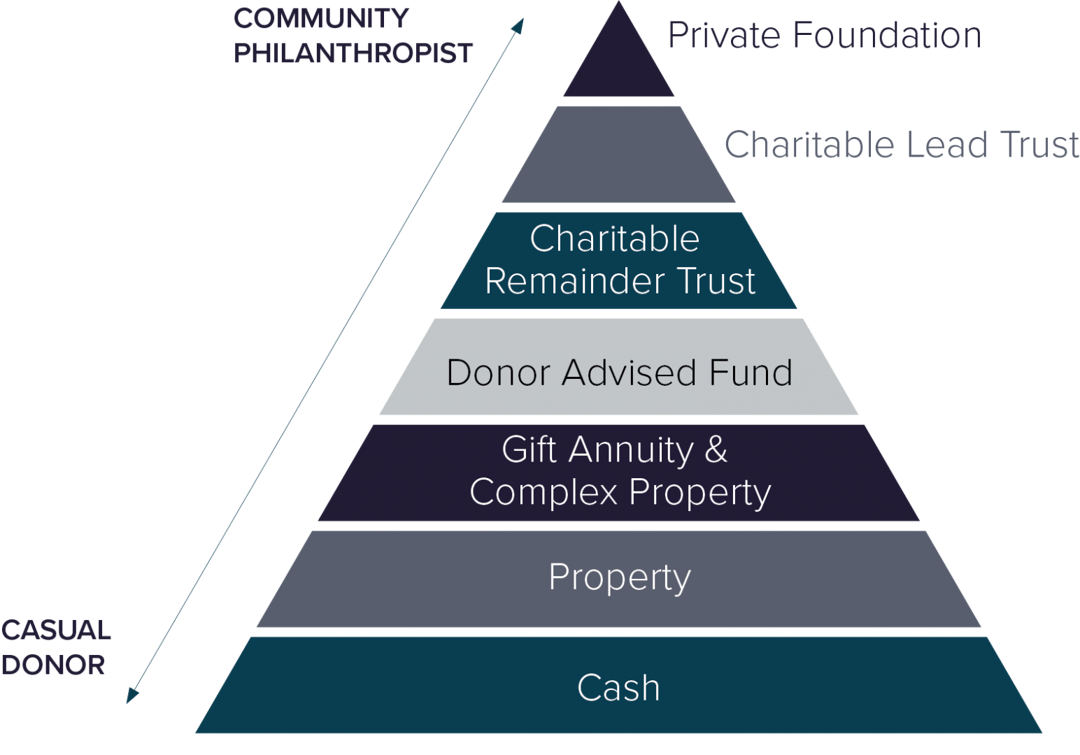

Charitable Lead Trusts Generally A CLT is a split-interest irrevocable trust. A trust that makes a series of payments at least annually to charity for a term of years or over a lifetime and then distributes the remaining principal assets of the of the trust either. Charitable Lead Annuity Trust Defined.

A charitable lead annuity trust CLAT is a type of charitable trust where a charity donor advised fund or foundation of the grantors choosing the Lead Beneficiary receives annual payments either for a term of years or the grantors lifetime. One an Annuity Trust often referred to as a CLAT where the charity receives an annuity that is either a fixed percentage of the initial fair market value of the trust assets a fixed sum or an amount that is based on a formula intended to produce a specific tax result. A charitable lead annuity trust gives you a way to make a large gift to charity get a tax break and eventually leave assets to family members.

Charitable lead annuity trusts CLATs to their clients. The CRT also gets the assets out of the grantors estate avoiding estate taxes. I to the clients family members outright or in further trust.