Deferred Annuity Taxation

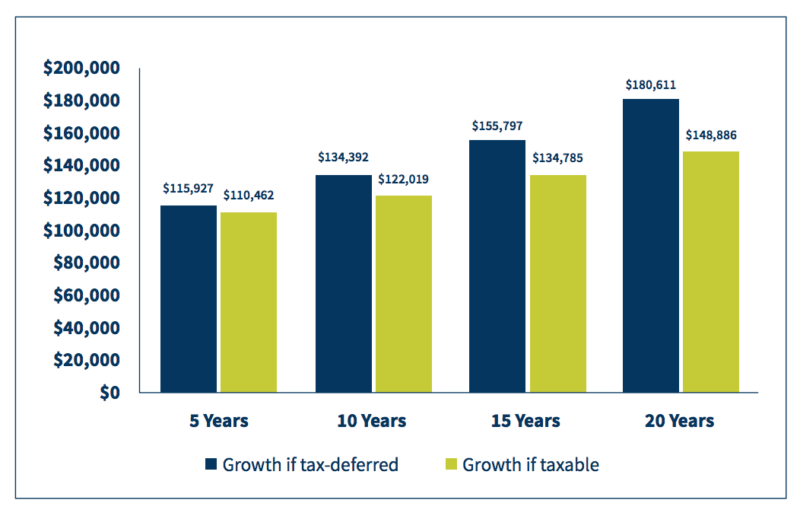

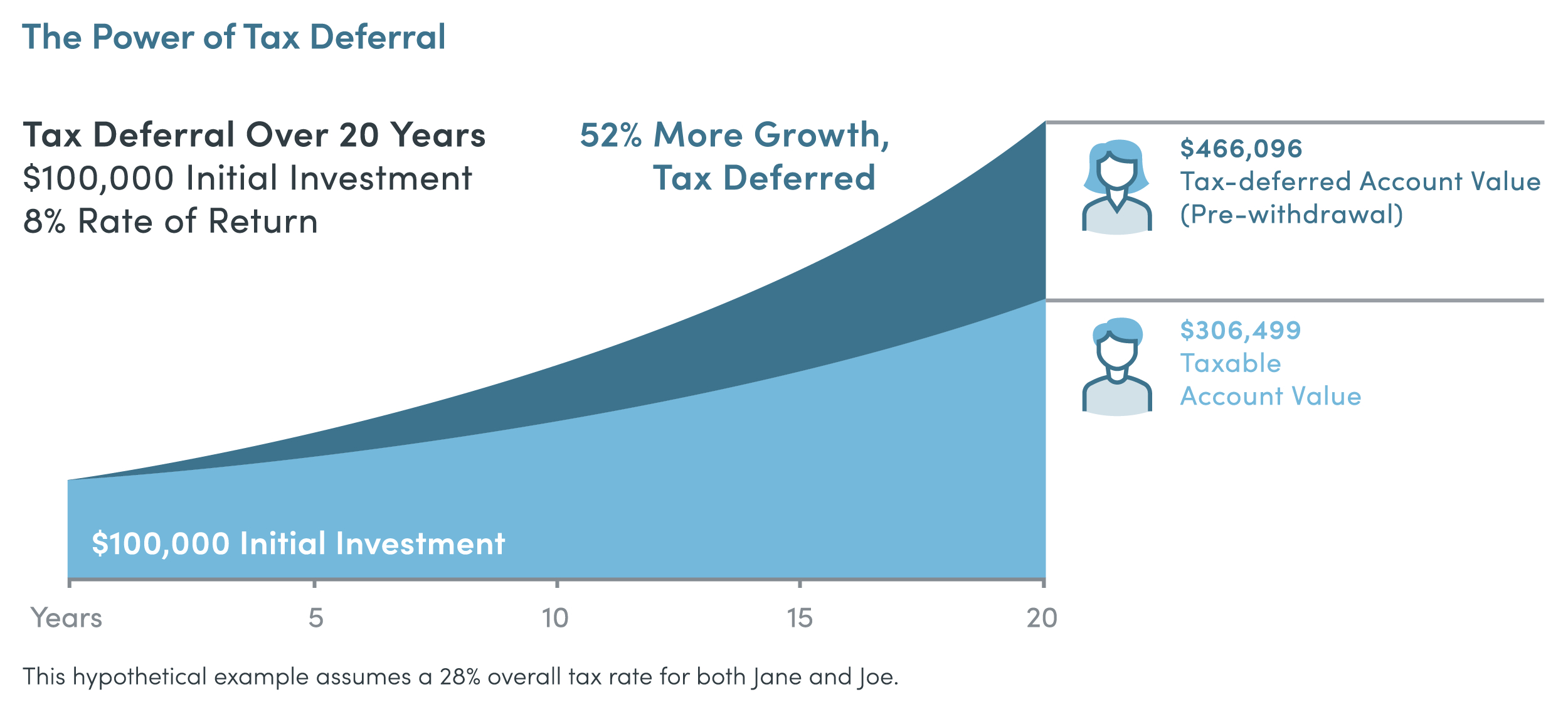

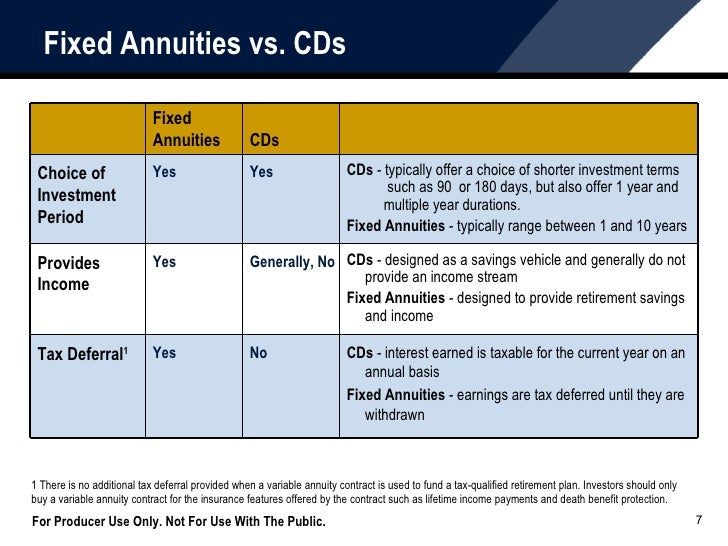

A Tax Deferred Annuity is one of few retirement investments that offer tax deferred compounding of investment gains.

Deferred annuity taxation. The annuity can buyer can get tax benefit on the contribution payment on a deferred annuity. While you wont receive a tax deduction for the money you contribute your account grows without. Tax deferral for annuity money Once the money is in the annuity though it gets the same tax deferral that IRA and 401 k money gets.

But thats only if you and an annuity are match-made in heaven. Updated December 01 2020 A deferred annuity is an insurance contract designed for long-term savings. At the minimum this means that youve maxed out your other retirement contributions are in a high tax.

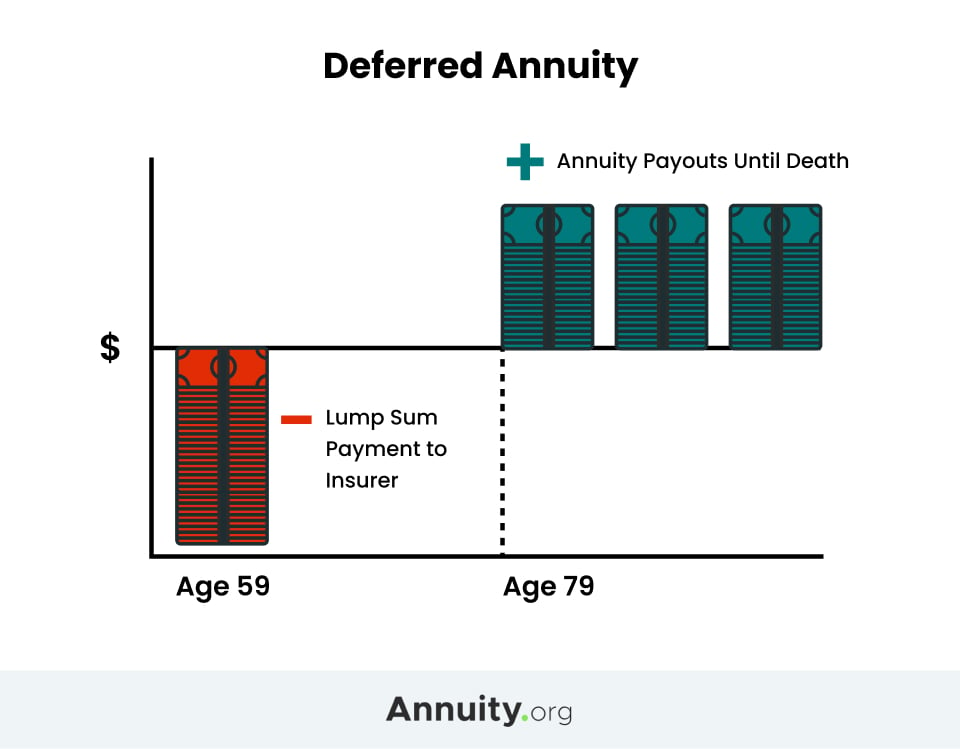

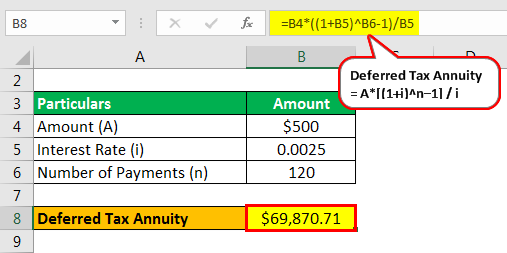

1 With this annuity you invest your funds with an insurance firm. A deferred annuity is an insurance contract that guarantees income at a future date. During that time any earnings in the account are tax-deferred.

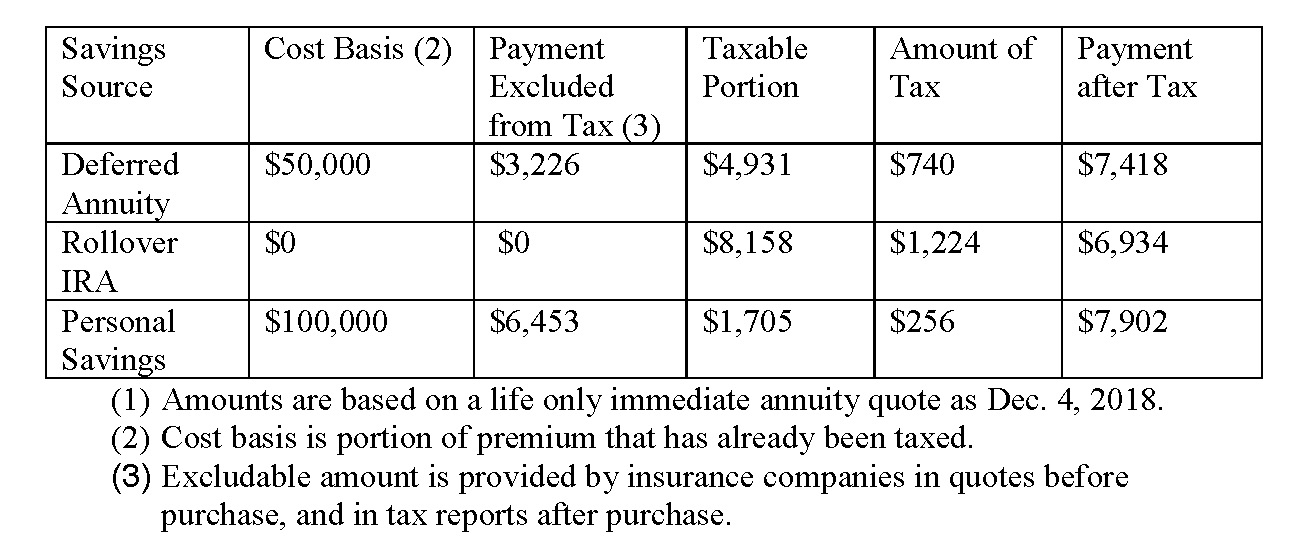

Tax Deferred Annuities offer these advantages and are popular savings and investment plans for individuals who want to save on a taxes for many years. Deferred annuity tax benefits Money made through a deferred annuity is only taxable upon withdrawal. The uses of deferred annuity are as follows.

How Deferred Annuities Work. You dont pay taxes on it until you take money out. Your withholding strategy may depend on your overall income and tax bracket at that time.

Home What is a tax-deferred annuity A tax-deferred annuity refers to the fact that money in an annuity can grow without paying taxes right away. Unlike a 401 k or IRA theres no limit to the amount of money you can put in it in any single year. Nonqualified variable annuities are tax-deferred investment vehicles with a unique tax structure.