Equity Indexed Annuities Pros And Cons

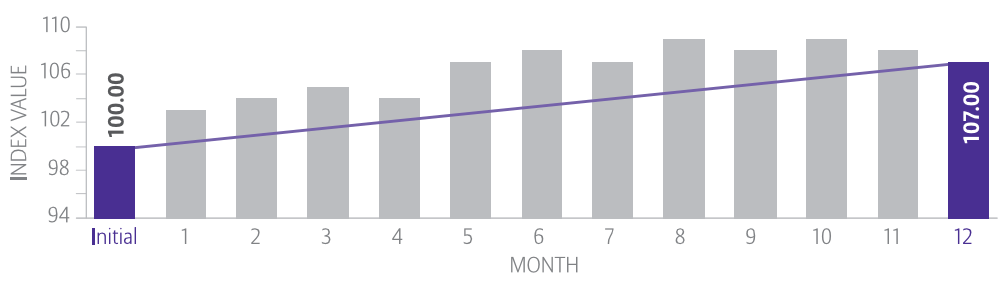

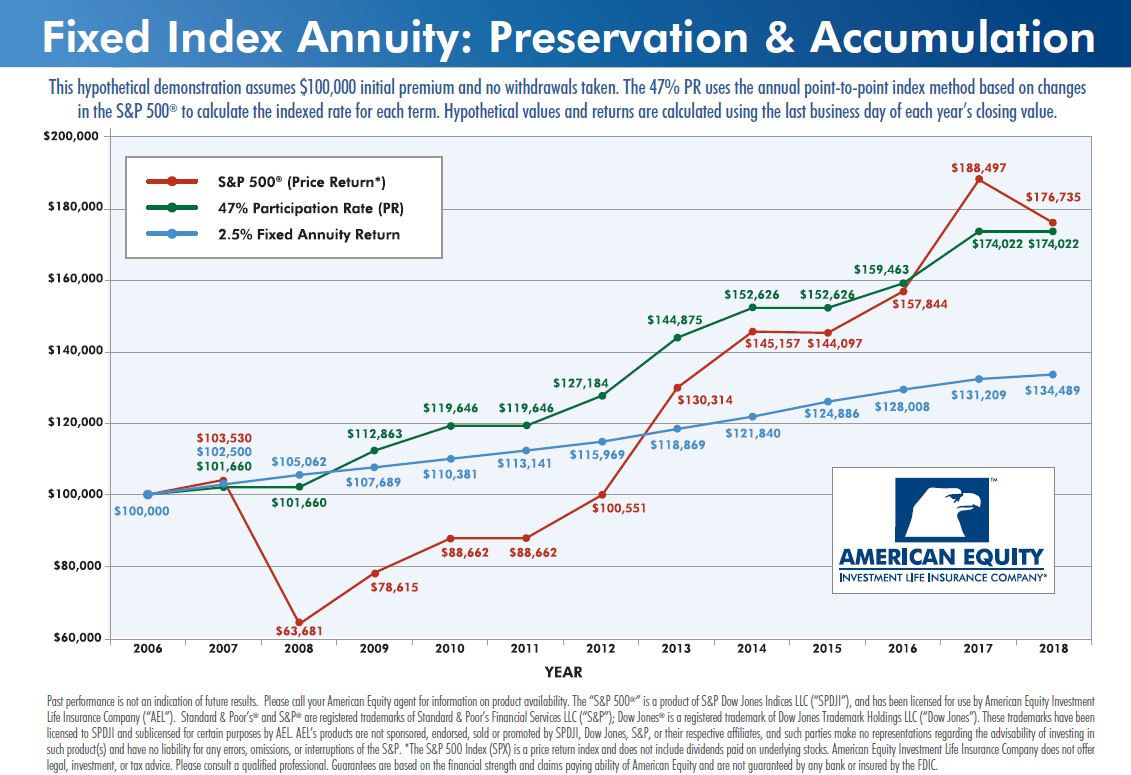

An indexed annuity exposes you to the stock indices like the SP 500 and guarantees the return of your principal investment.

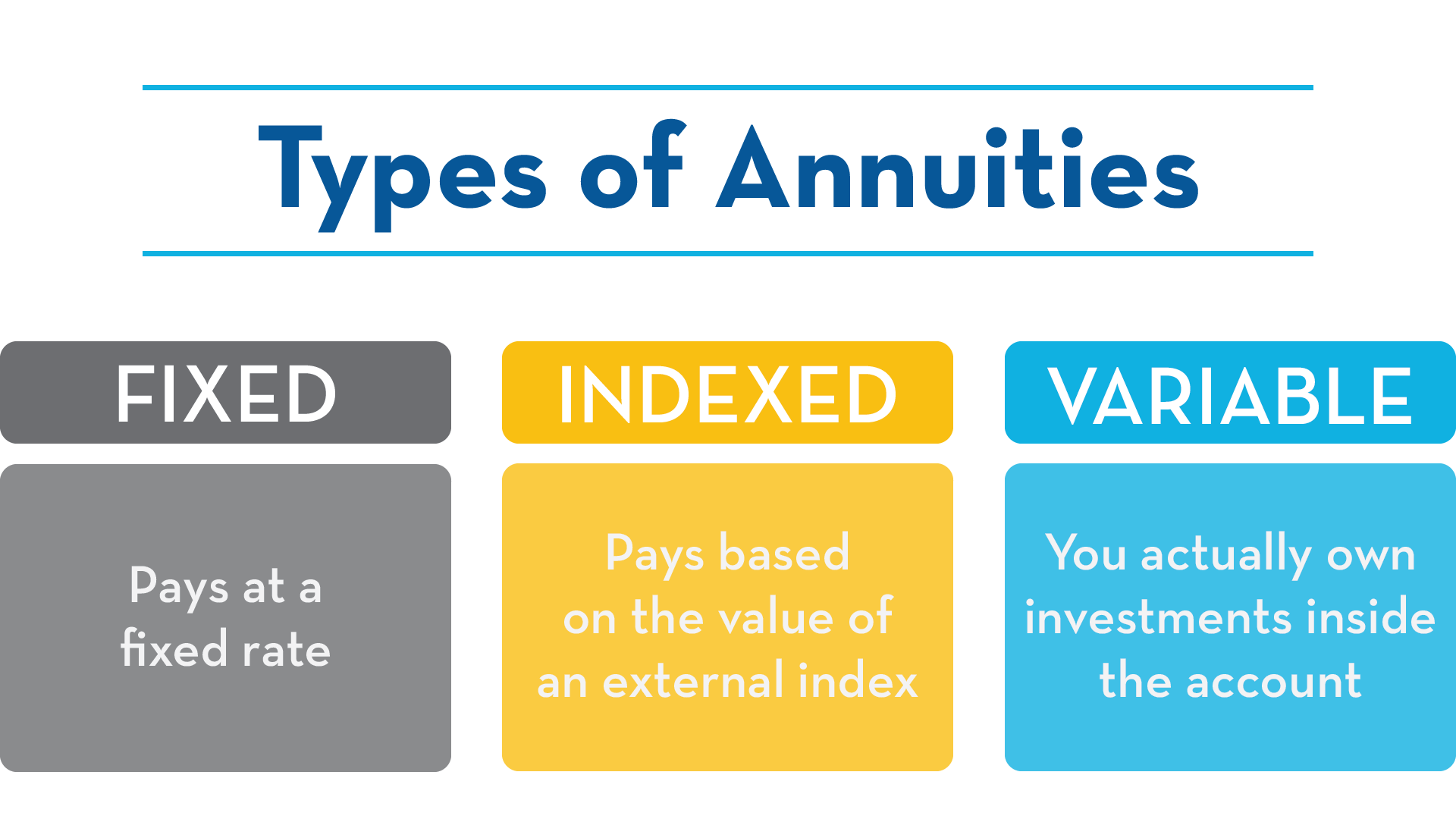

Equity indexed annuities pros and cons. Equity indexed annuities are insurance contracts that are structured to provide you with a monthly income stream. An equity indexed annuity is an investment made through a contract with an insurance company which has variable and fixed annuities. Even so take notice of the following disadvantages.

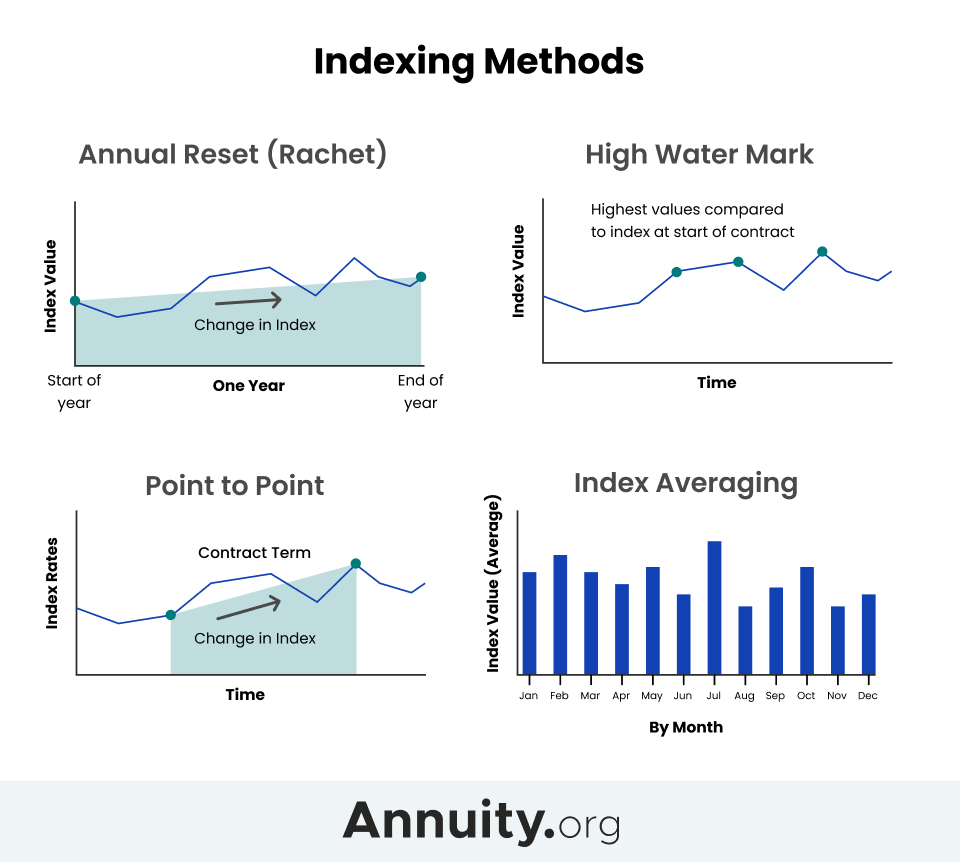

Basic properties of equity-indexed annuities The equity-indexed annuity is a unique type of fixed annuity. When an index annuity is part of a retirement plan its cons are outweighed by its minimum guaranteed rate and growth potential. There are many different types of annuities each with its own pros and cons however all annuities share certain features.

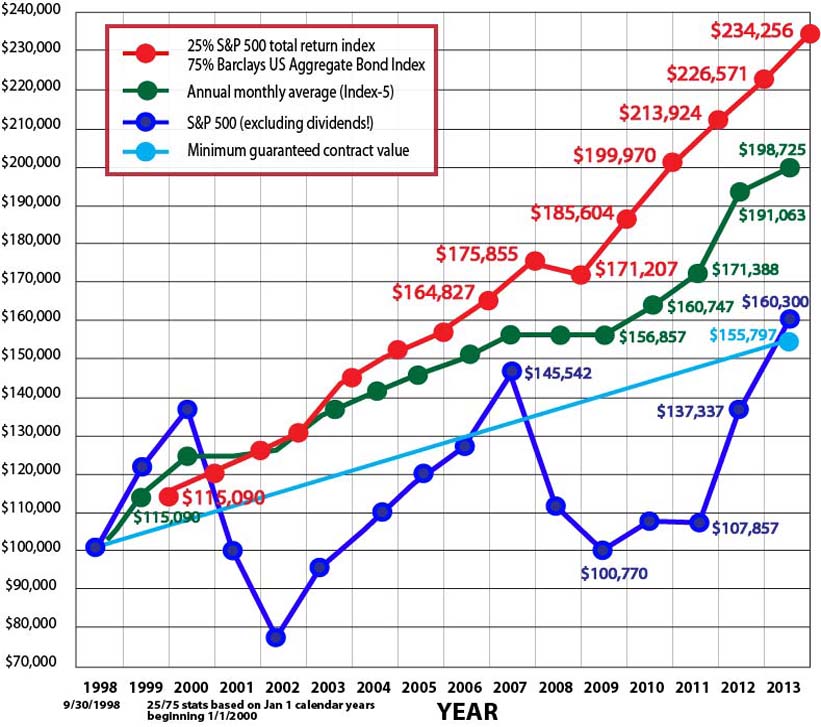

They have the potential of higher returns without the risk of losing your money. Indexed annuity investments and payments are tied to stock market indexes such as the SP 500. At the least youll usually get as much money back as you paid in.

An Index Annuity Grows Tax-Deferred Earnings within an annuity contract are tax-deferred. Pros and Cons of Indexed Annuities Indexed annuities are a low-risk alternative to variable annuities and provide a guaranteed stream of income. 10 IRS Penalty Withdrawing income before the age of 595 results in a 10 IRS tax penalty.

Equity Indexed Annuities Pros and Cons A fixed annuity is a retirement investment product developed and maintained by life insurance companies. A fixed annuity is a retirement investment product developed and maintained by life insurance companies. They promise to provide some exposure to market increases with limited downside risk.

Your broker might have claimed FIAs provide the peace of mind supposedly offered by fixed annuities while still providing market-like growth offered by variable annuities products that deliver periodic payments with the amount varying based on the performance. Annuities like equity-index annuities may promise that you cant lose money in the stock market. An indexed annuity is a hybrid that combines elements of fixed and variable annuities.