Fixed Annuity Taxation

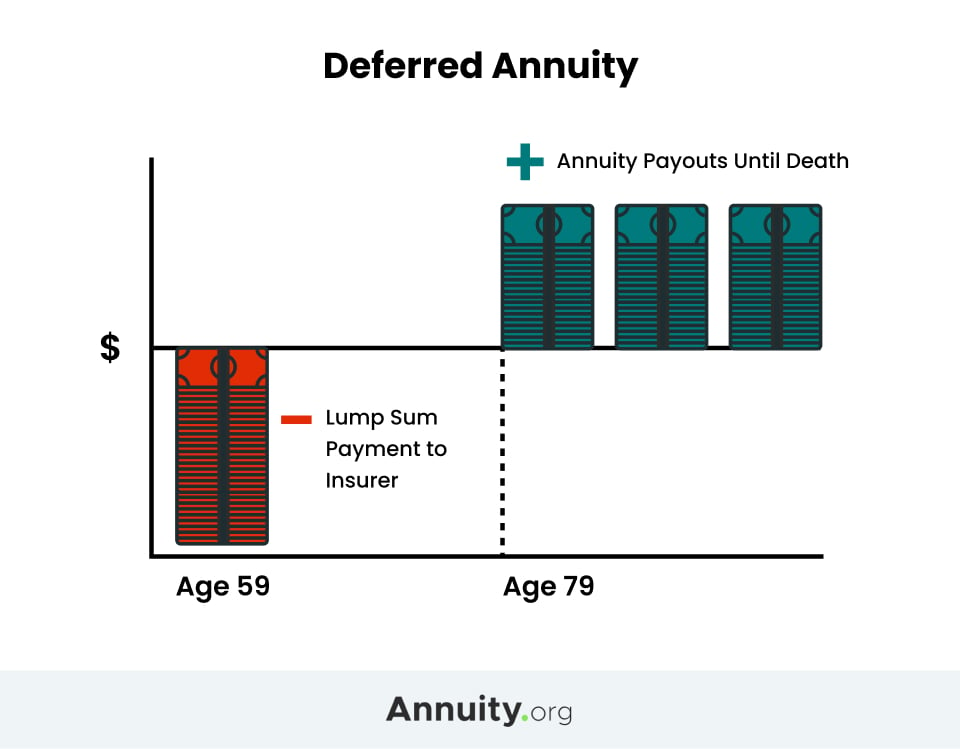

For the time being though just know that a fixed annuity is a tax-deferred high-yield savings account designed solely for retirement savings.

Fixed annuity taxation. Qualified annuity distributions are taxed at the individuals marginal income tax bracket. In general gains or earnings which are withdrawn from fixed index or multi-year annuities are taxed as ordinary income not as capital gains. The annuity purchase price is returned in equal income-tax-free amounts over the expected payment period based on the annuitants life expectancy.

In a tax-deferred retirement account like an Individual Retirement Account IRA or a 401 k you may pay taxes on the annuity during your payout period. Fixed annuities can be more cost-efficient especially when an independent agent obtains quotes multiple insurance companies. Fixed annuities offer tax-deferral advantages over standard cash allocations due to how the exclusion ratio can level taxation.

For fixed annuities this is less a concern as bond interest is already taxed as income. However IRAs are already tax deferred so annuities tax deferral really provides no additional tax benefit. Many annuities guarantee a fixed income stream for life.

However when you purchase this type of annuity the insurance company takes your life expectancy into consideration. How Annuities Are Taxed. However the beneficiary is entitled to deduct a portion of estate tax paid on the annuity for income tax.

Tax Treatment of Annuity Withdrawals. Then by multiplying 75 by the amount of each payment youll see how much of the payment will not incur taxes. Accordingly its smart to formulate a plan to deal with these future taxes.

If your annuity was funded with Roth IRA. An annuitys tax structure depends on the account in which it is held. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account.