Fixed Annuity Vs Variable Annuity

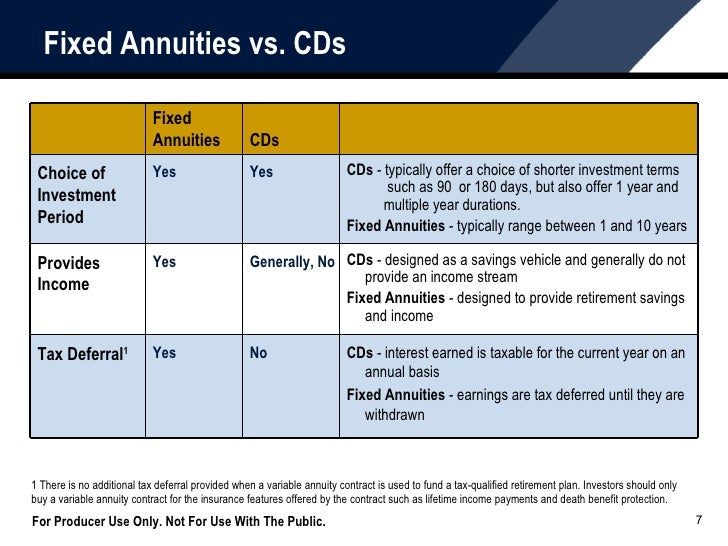

With fixed annuities interest rates are clearly outlined in the contract.

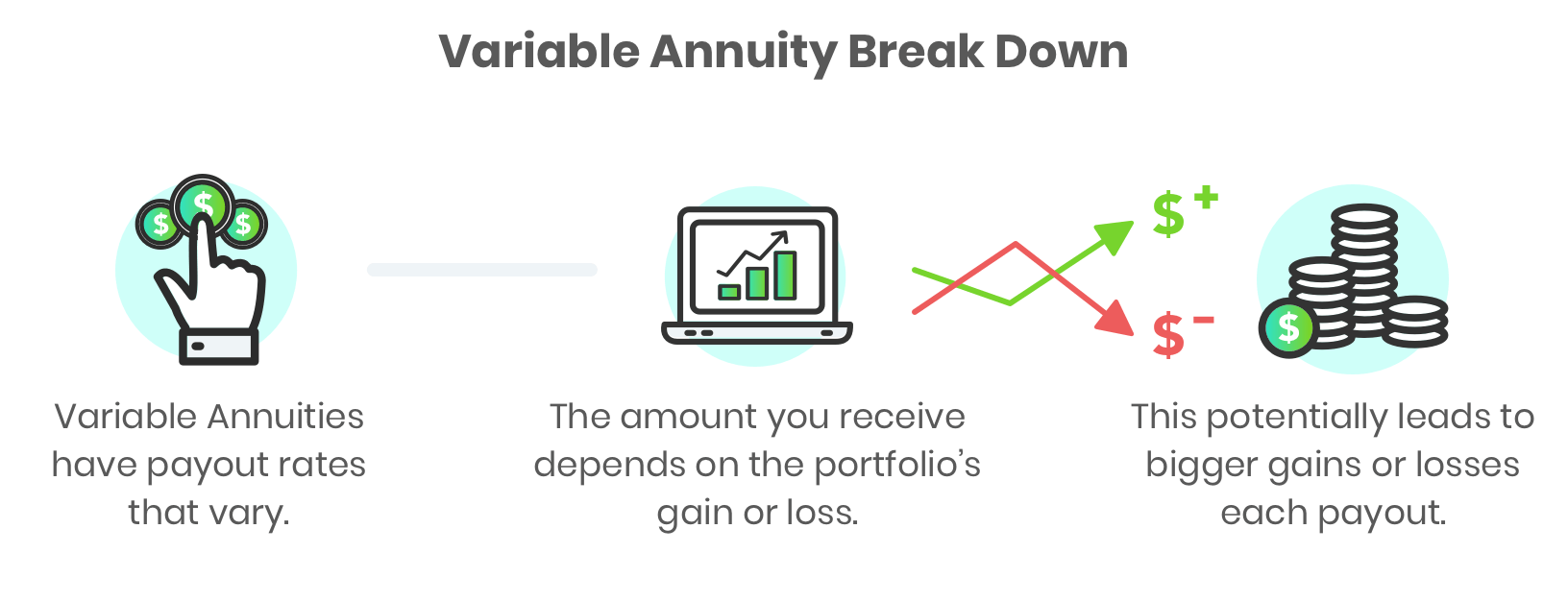

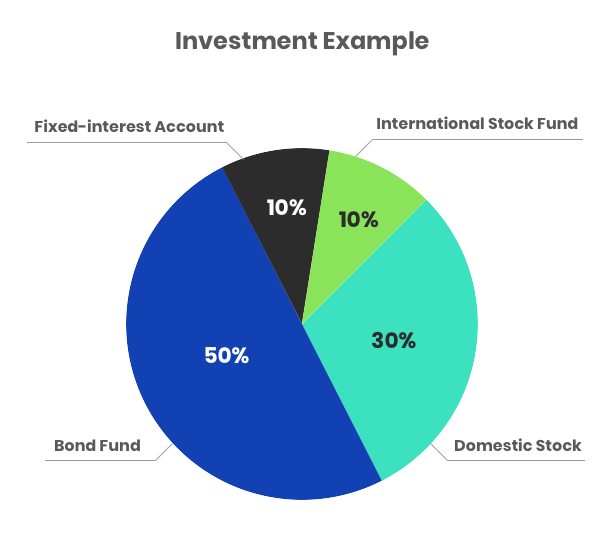

Fixed annuity vs variable annuity. Those nearing retirement who want to shelter their assets from the volatility of the stock or bond market. With a variable annuity the insurance company invests the initial funds in sub accounts according to the investors choices. According to Suze Orman a variable annuity is continued below video.

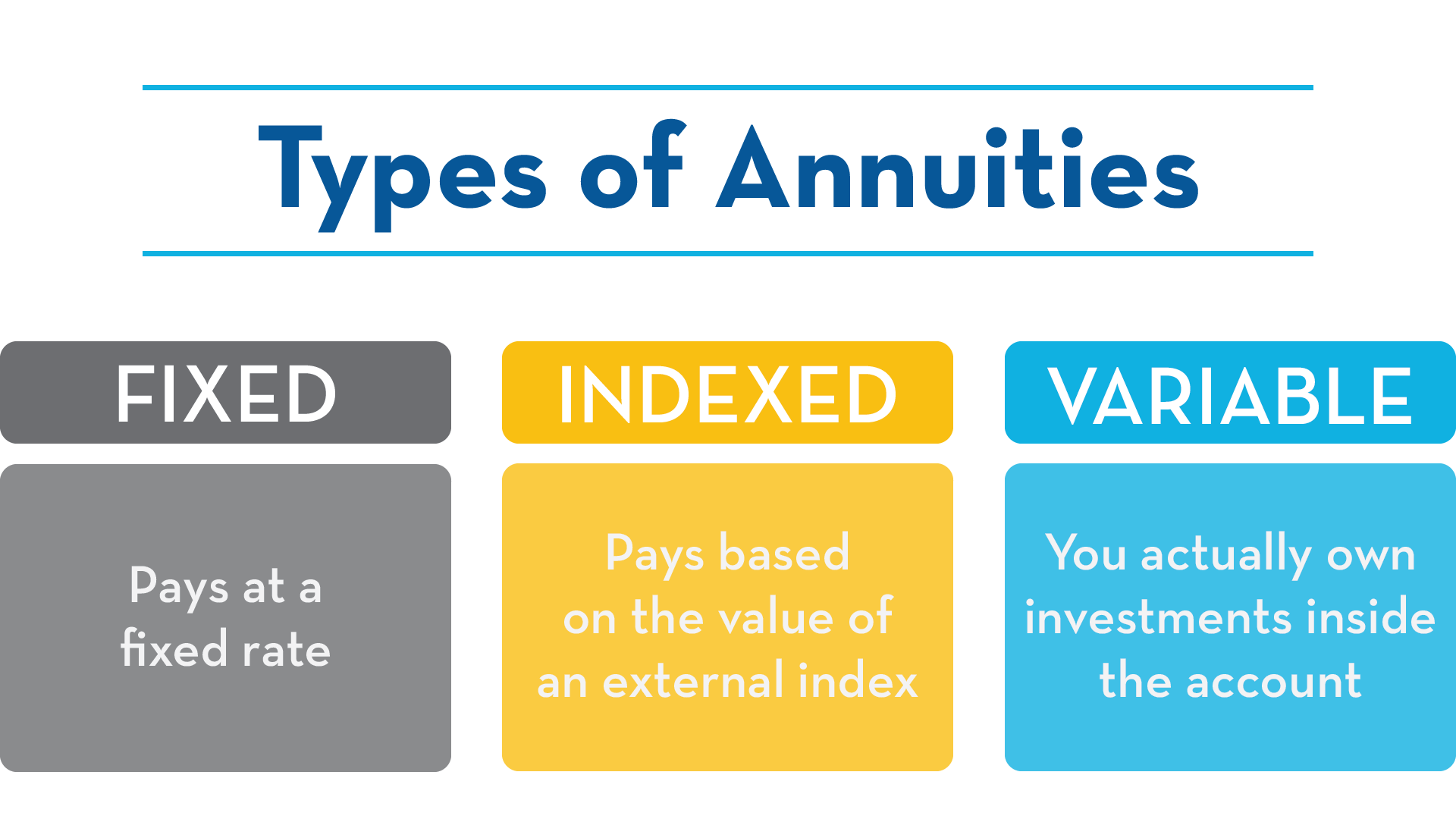

With a fixed annuity the insurance company guarantees a specific payment to the account holder based upon the initial investment. The growth rate of variable annuities depends on the performance of an investment portfolio. Before we can describe fixed-indexed annuities its important to first understand the most basic forms of annuities.

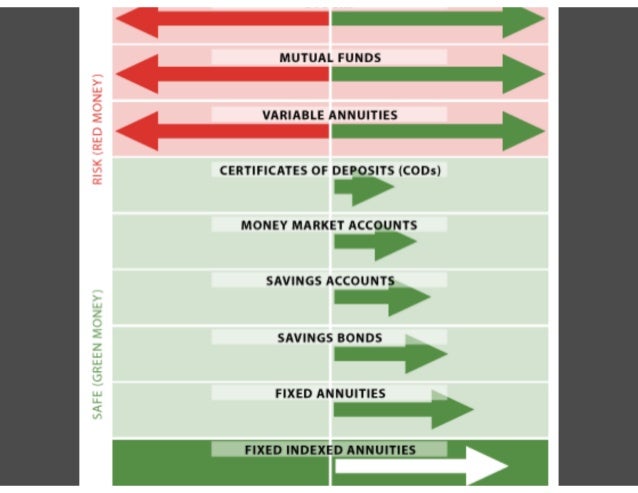

The insurance company pays a fixed rate of return and absorbs any market risk. An annuity can help you create a stream of guaranteed income for retirement. A fixed annuity might be a better option for a more conservative investor while a variable annuity might be a better option for someone who can handle a little risk.

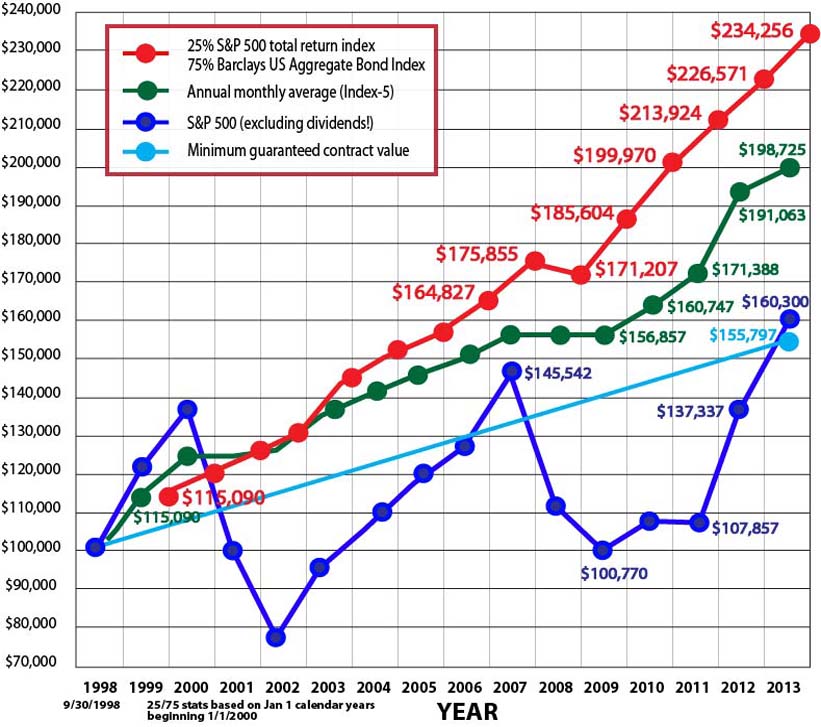

The key feature of a variable annuity is that you can control how your premiums are invested by the insurance company. Find info on TravelSearchExpert. We on the other hand try and take a bit more balanced position when comparing the variable annuity to the more popular Market Free fixed index annuities that many folks are incorporating as a must have annuity in their retirement plan.

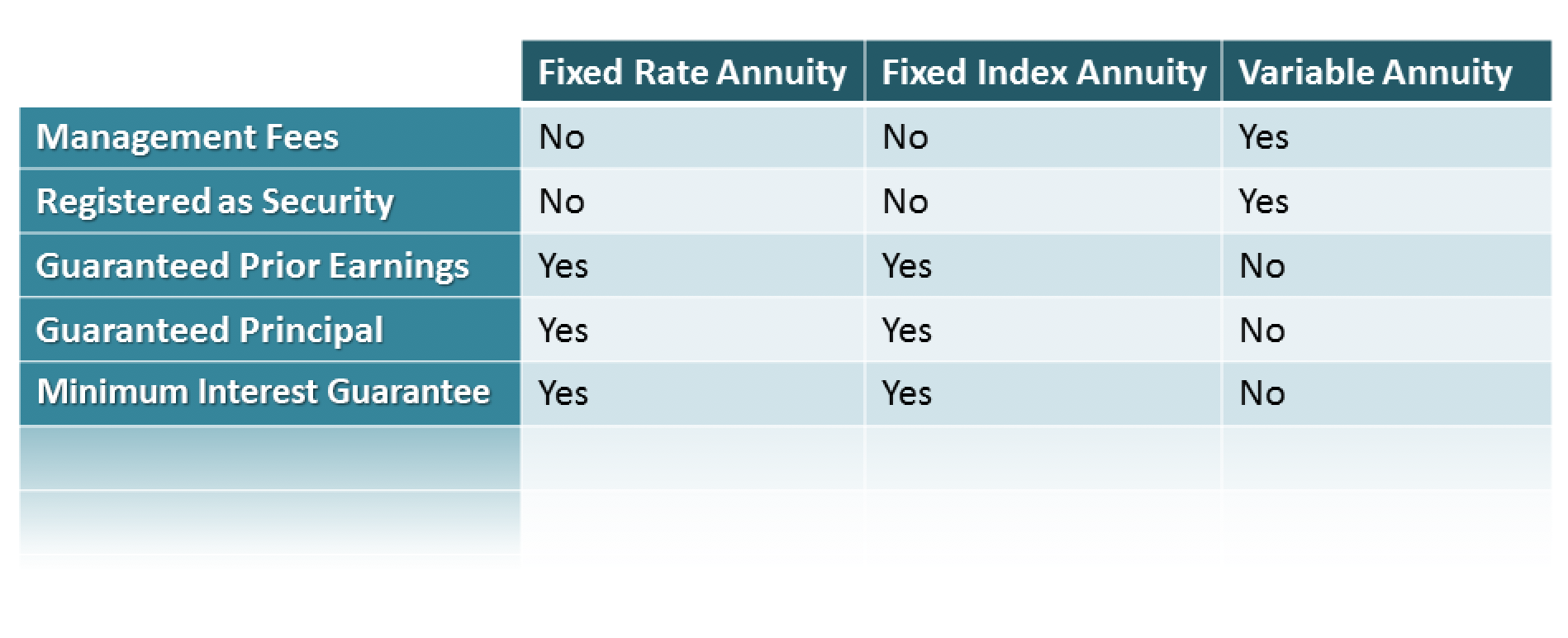

Conservative investors who value safety and stability. The three main differences are. Unlike a variable annuity where your rate of return depends on market performance fixed annuities offer a fixed rate of return for the duration of the contract.

With variable annuities you can invest in a variety of securities including stock and bond funds. A fixed annuity guarantees payment of a set amount for the term of the agreement. Find info on TravelSearchExpert.