Flexible Premium Annuity

Consider the pros and cons as you weigh different annuity options.

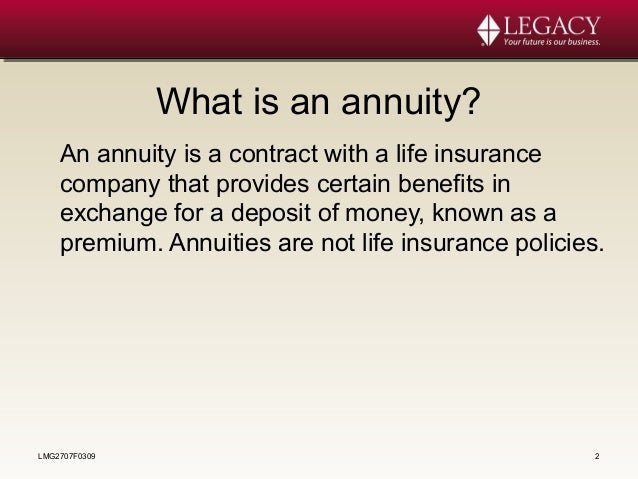

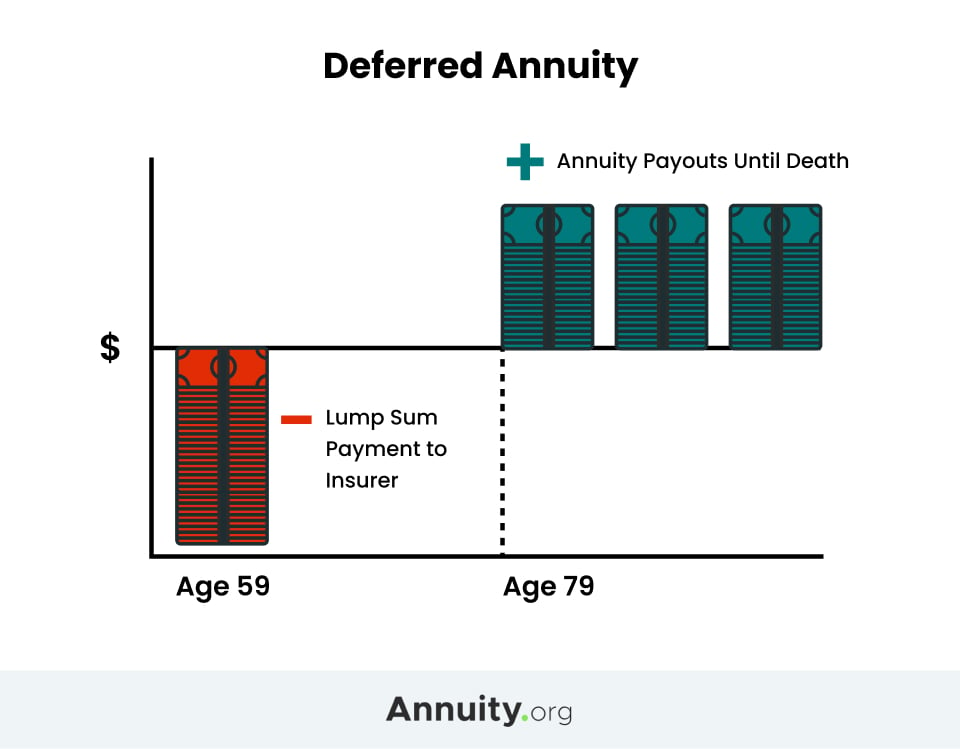

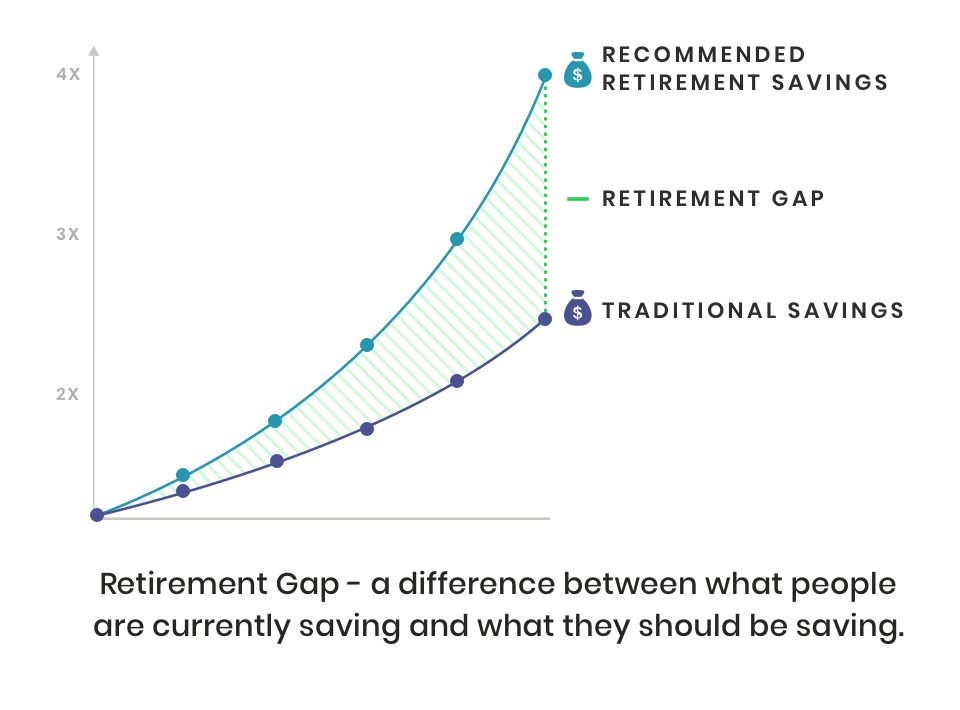

Flexible premium annuity. As a result you dont have to make one large lump sum premium payment. Being a flexible premium annuity there is no fixed or mandated amount that is to be paid by the annuitant or the contract holder. A flexible premium deferred annuity offers a way to invest in an annuity without having to pay a large lump sum premium all at once.

You would have to pay a small amount to start the annuity but you. So a flexible premium deferred annuity is an annuity that you pay into incrementally over time and that you defer receiving payments from until a later date. If a flexible premium deferred annuity sounds like it may be a good fit for you here is some more context into how they work and what you might want to think through before purchasing one.

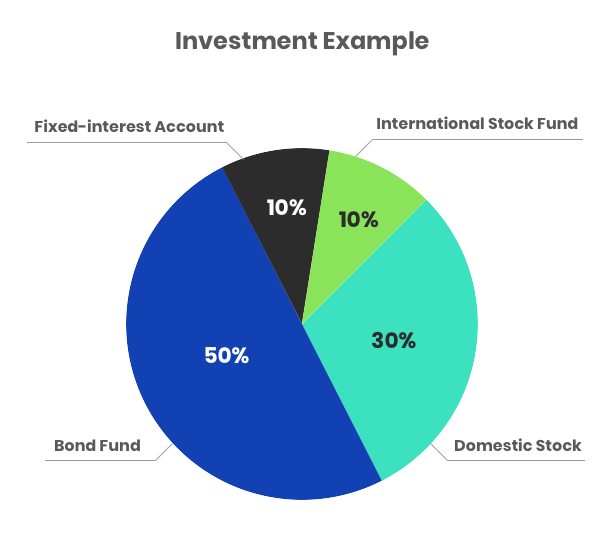

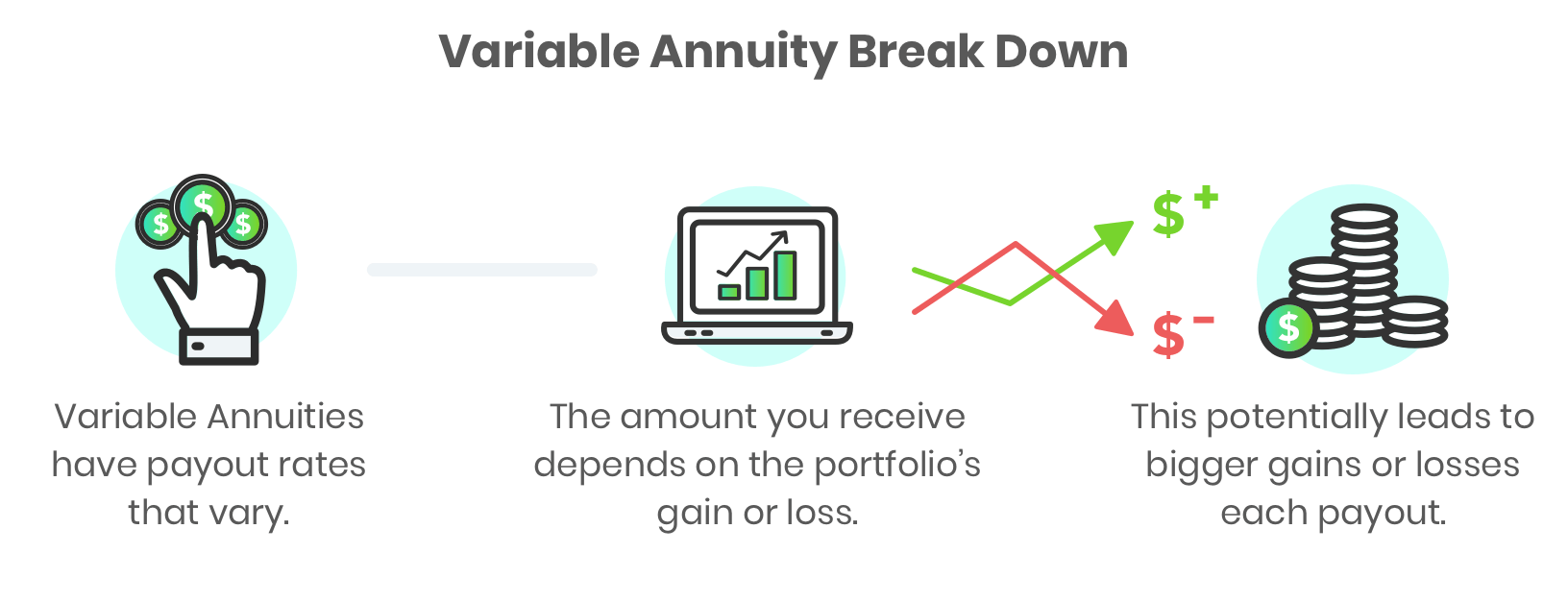

What Does Flexible Premium Deferred Annuity FPDA Mean. You make one initial premium payment then additional payments at your own pace. A Mutual of America Flexible Premium Annuity FPA is a tax-deferred variable annuity contract designed to help you build savings for retirement.

The flexible premium option is available only for annuities with deferred income start dates. A flexible premium deferred annuity is a simplified product offering that is used to grow your money over time. A flexible premium annuity is a retirement plan that allows the insured to choose the mode of payment for their premiums and their retirement income.

In some cases the company may however prescribe a certain minimum amount that needs to be paid on an annual basis to keep the annuity valid. Immediate annuities which are also known as income annuities and include single premium immediate annuities SPIAs and deferred income annuities dont have an accumulation phase. Flexible premium deferred annuities are guaranteed and grow on a tax-deferred basis meaning you wont pay taxes until you begin receiving payments.

You can schedule payments control the taxes on earning and take payouts as a lump sum or over time. This annuity is also an excellent way to enhance your clients retirement-savings plan and can be used to fund 403b TSAs for existing plans with new participants only Traditional IRAs Roth IRAs Pensions Plans or Simplified Employee. Flexible Premium Deferred Annuity Defined.

.webp)