Grantor Retained Annuity Trust Calculator

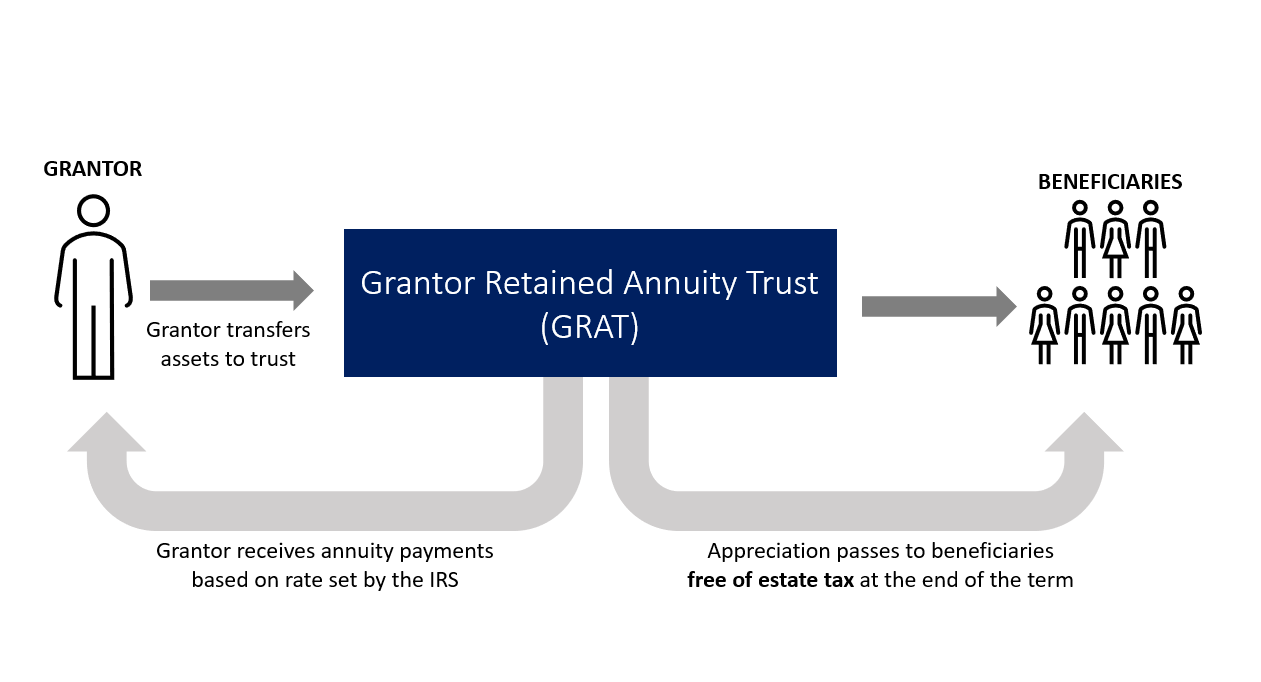

Grantor Retained Annuity Trusts are one estate planning tool used to reduce inheritance taxes by removing assets from an estate.

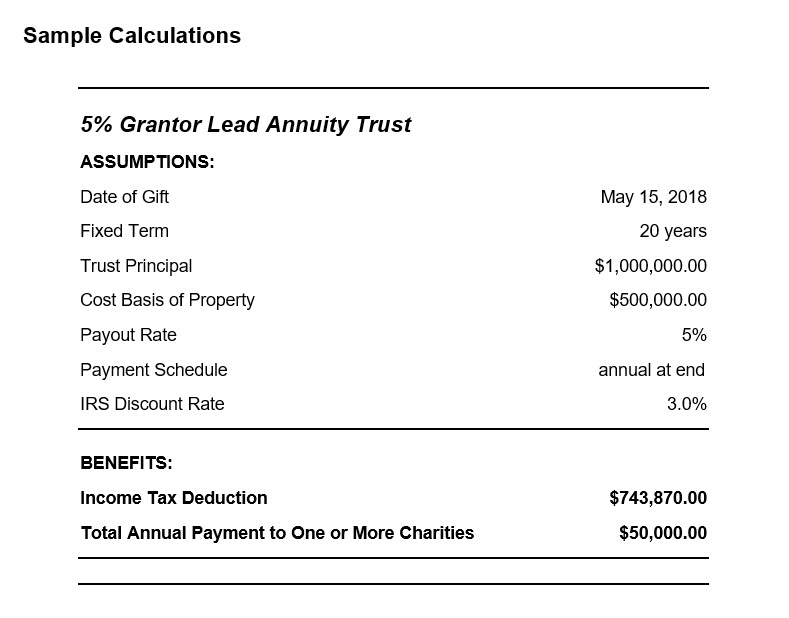

Grantor retained annuity trust calculator. A Grantor Retained Annuity Trust GRAT is a gifting strategy that may work well in todays market and interest rate environment. 000 Annual Growth of Principal. Calculates the value of the annuity interest retained by the grantor in a retained annuity trust GRAT for the grantors life a specified term or the shorter of both.

7520 rate in effect for the month the assets were transferred to the trust. Grantor retained annuity trusts GRAT is an estate planning tactic in which a grantor locks assets in a trust from which they earn annual income. Grantor Retained Annuity Trust Type of Calculation.

Upon expiry they receive the assets tax-free. The IRS assumes that the trust assets will generate a return of at least the applicable Sec. 265900 Beginning Year 2 Value.

Utilizing the calculation any remainder value expected to pass to the trust beneficiaries is. 5 Total Number of Payments. You must calculate the present value of the future annuity payments coming back to the grantor and the present value of the remainder assets when the trust ends that will pass to the beneficiaries.

Taxable Gift of Residual Interest in Trust. The regulations provide that the includible portion is the lesser of 1 the fair market value of the trust corpus on the decedents date of death or 2 a computed amount. A Grantor Retained Annuity Trust often referred to as a GRAT operates as follows.

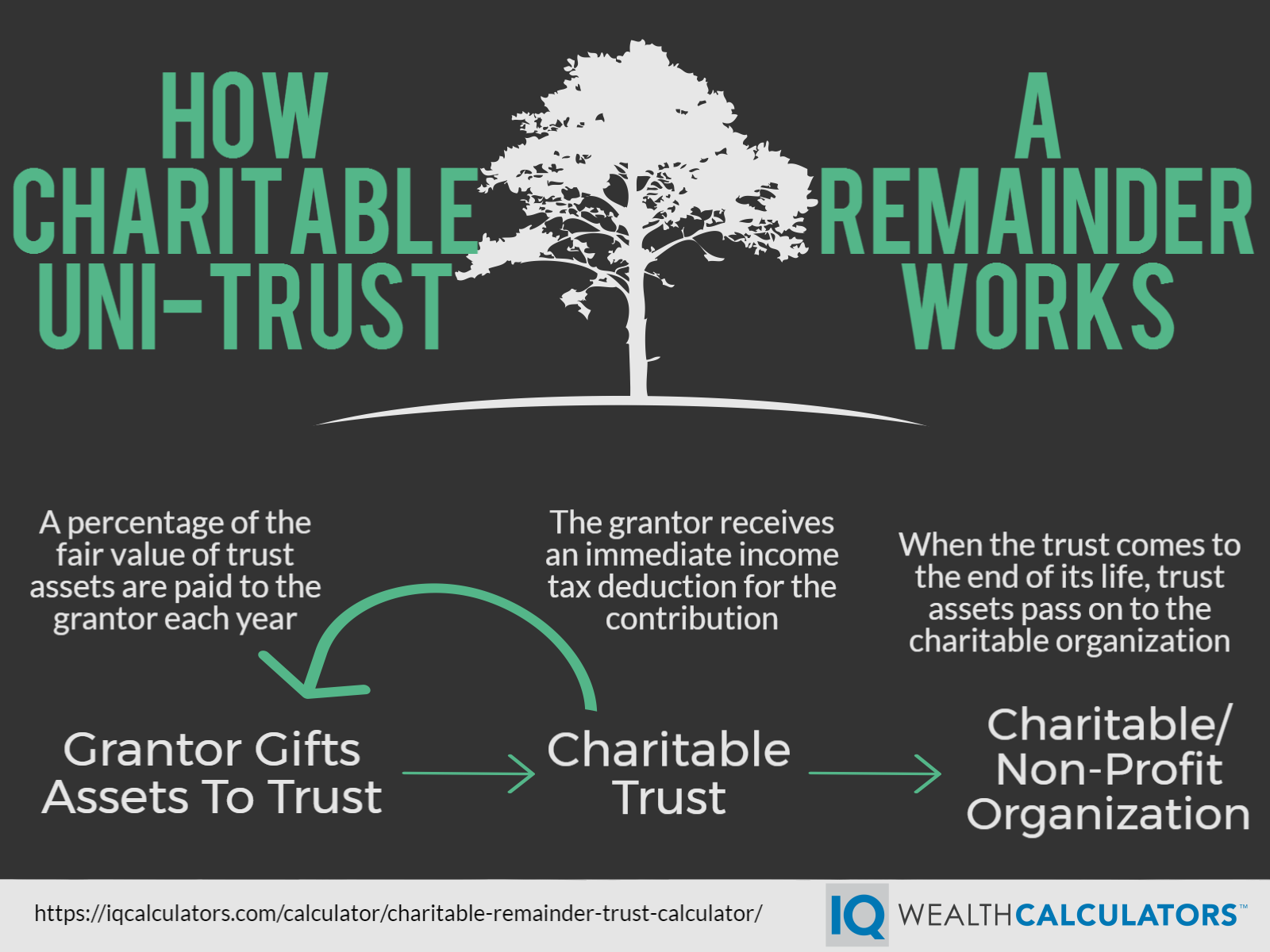

The Donor transfers high income-producing assets or assets with substantial growth potential or cash to be invested in such assets to. Please note however that this calculator functions as a stand-alone feature. 60 Income Earned by Trust.