Inflation Indexed Annuity

A 100000 inflation-adjusted annuity policy from.

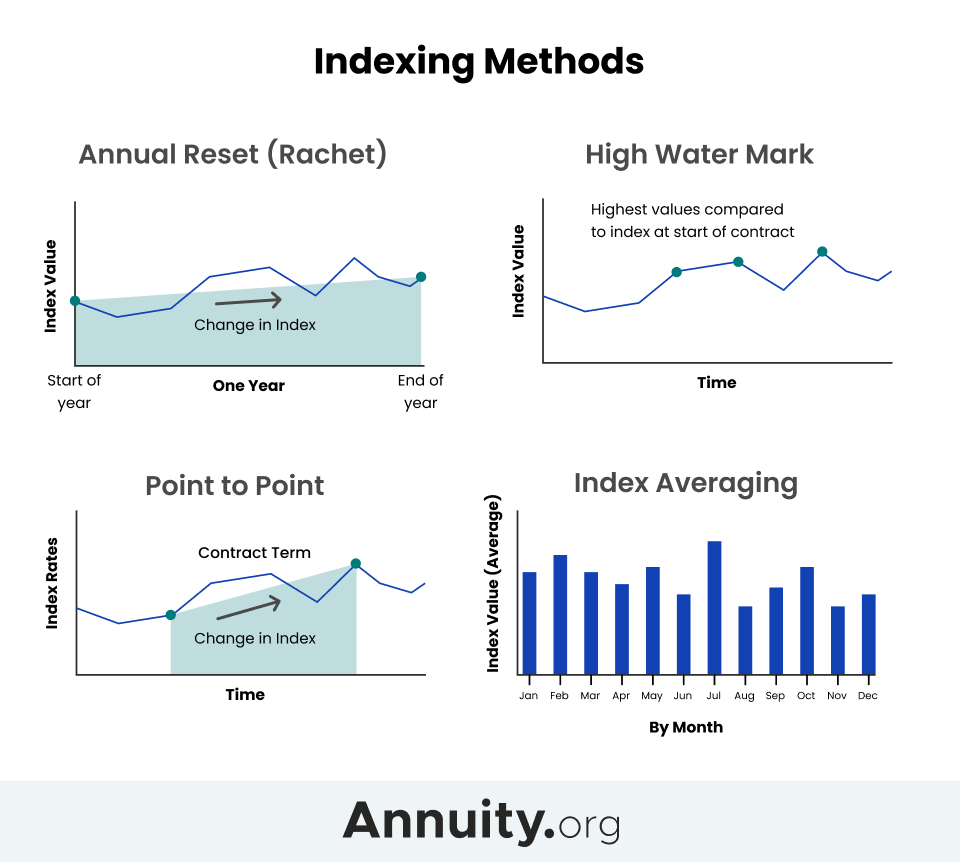

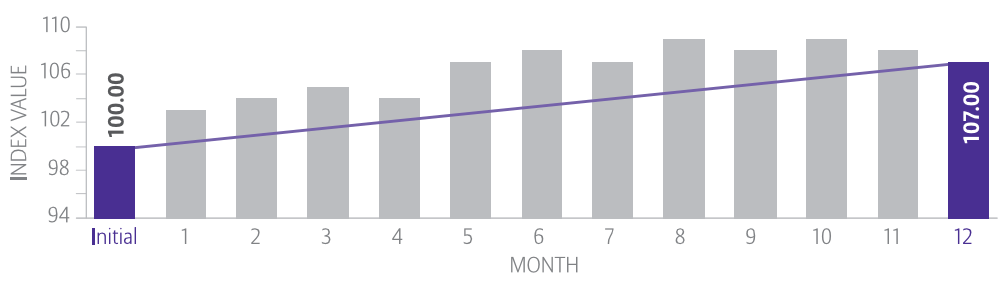

Inflation indexed annuity. With an indexed life annuity you have to select an annuity factor. A COLA SPIA with lifetime payments that increase by fixed percentage each year Penn Mutual. Inflation indexed immediate annuities are tied to the CPI.

Many annuity contracts apply the guaranteed interest rate to only a. In India annuities are not linked to inflation. Your actual annuity will vary depending on health shopping around whether you want your pension to be paid to your spouse after your death and other personal factors.

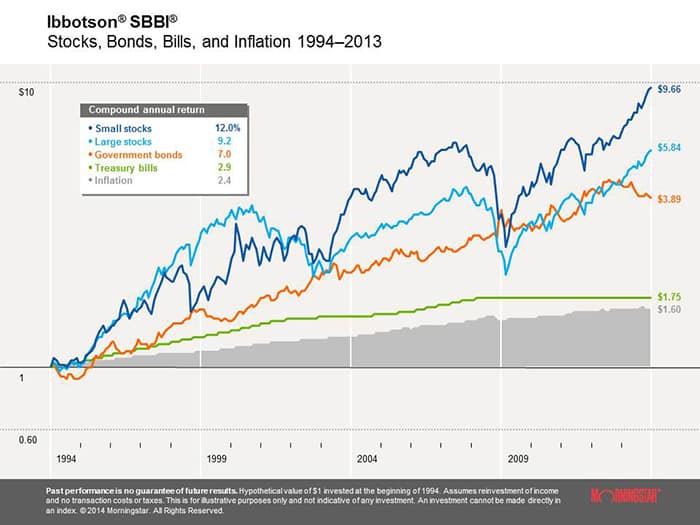

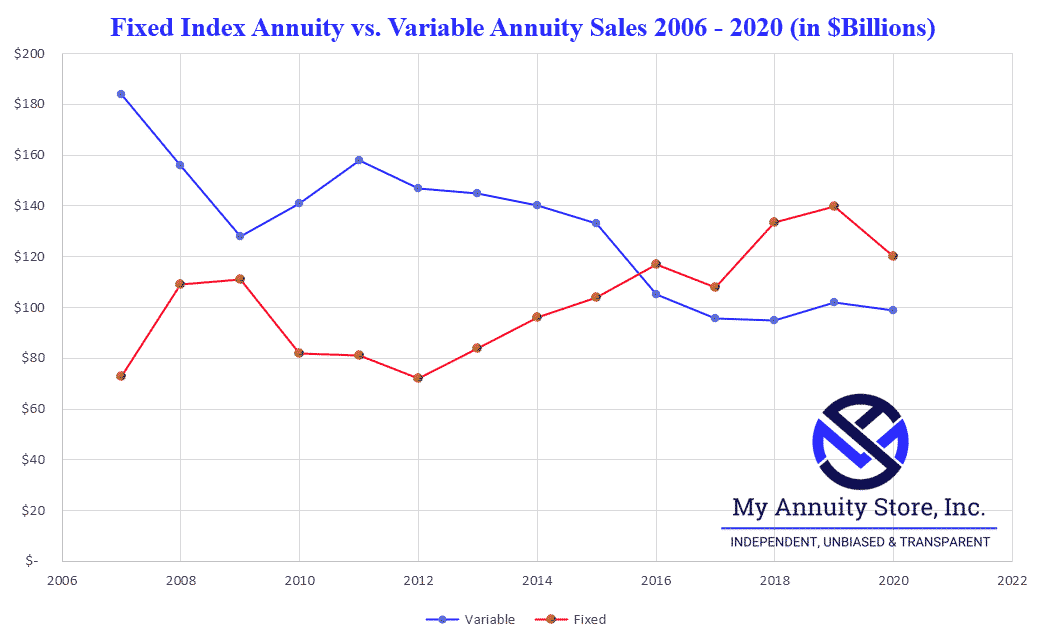

He also included as a product mix in his study a fixed indexed annuity FIA with a 30-year inflation-adjusted income rider. In a year that the index rises more than the cap rate the interest credit is the cap rate. LIC offers an annuity that increases 3 each year.

This feature is also referred to as a cost-of-living adjustment rider. Indexed annuities do not have fund management fees because. An inflation-indexed SPIA also called a real annuity with lifetime payments that adjust annually based on actual inflation CPI-U Principal Financial.

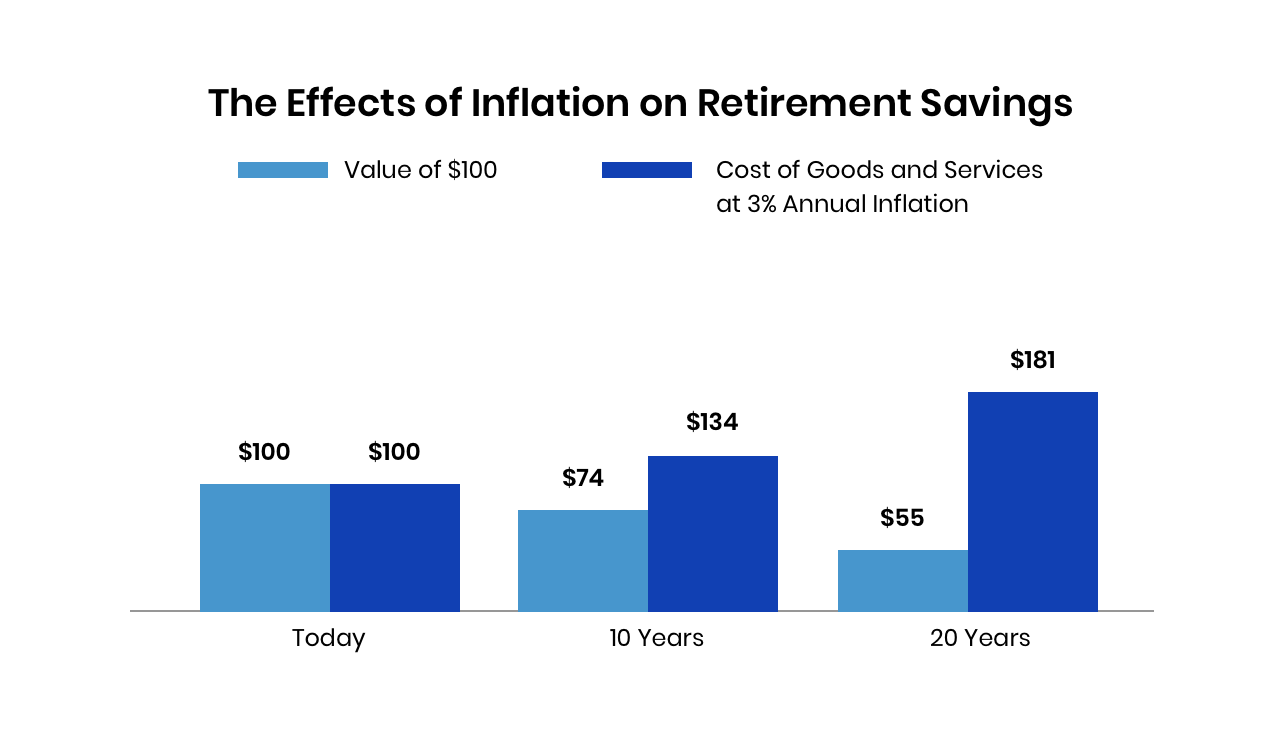

For example if your current monthly costs are 3000 they will be about 4000 in 10 years with only a 3 annual inflation rate. The indexed annuity is sometimes referred to as an inflation-indexed annuity. If a retiree has a large corpus buying an annuity is the very last thing a retiree should do.

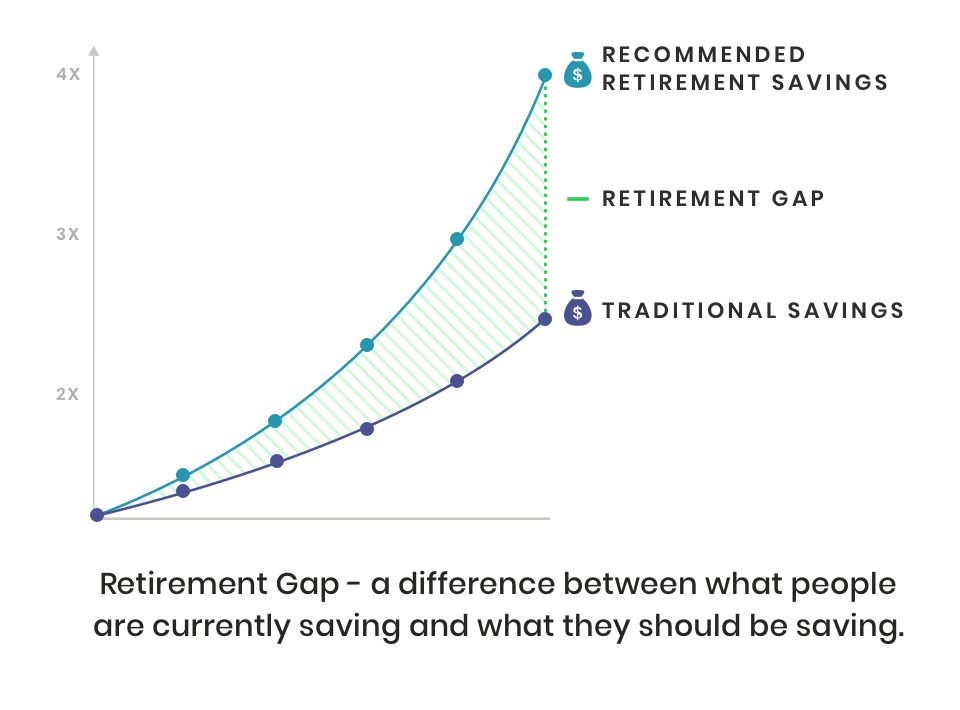

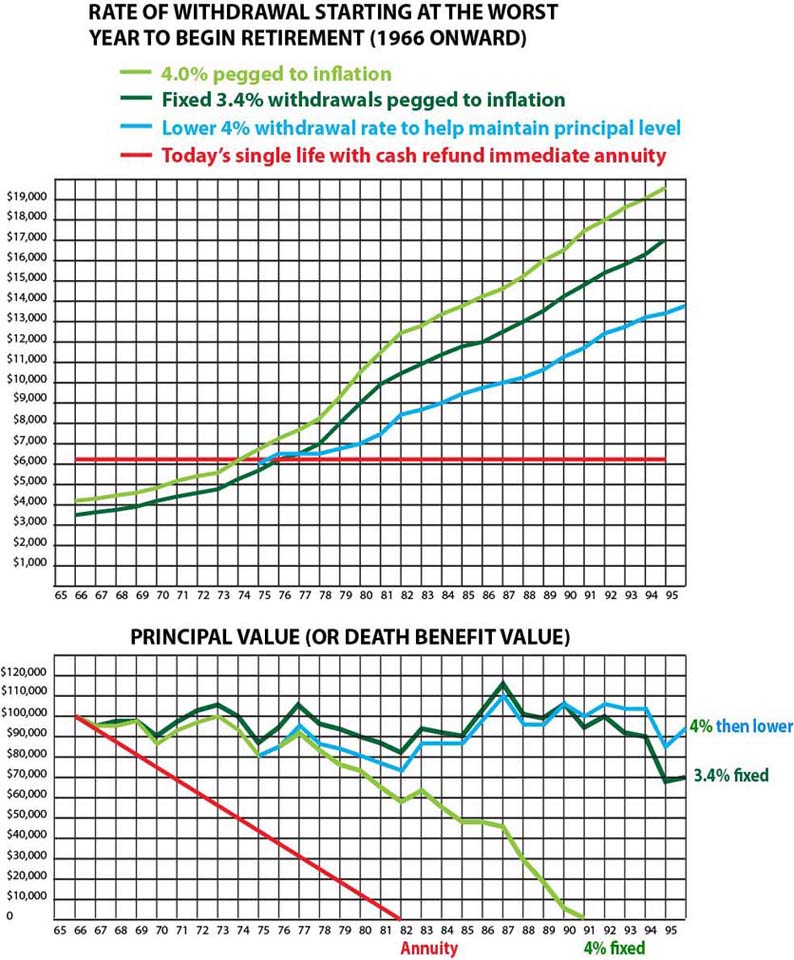

An inflation-adjusted annuity aims to solve the problem by giving you an automatic cost-of-living increase every year. For simplicity assume that the payment p is made annually right after the return has been earned. The FIA including worst-case guaranteed projections compared well against the stockSPIA combination with 3 assumed inflation.