Long Term Care Annuity Providers

Aimed to help our consumers make easier decisions when it comes to hard financial situations.

Long term care annuity providers. Silver Surfers Finance is a website compiled of expert financial advice. A hybrid LTC annuity is an ordinary-deferred fixed annuity that has a specified interest rate. Long Term Care Annuity Providers.

Annuity providers include insurance companies independent brokers banks and other financial groups. Some products require a simplified issue underwriting process while some annuities are guaranteed issueregardless of your health status. It includes the advantages of a traditional annuity plus the added benefits of long term care protection.

OneAmerica Annuity Care II. A rider is essentially an add-on you can include when purchasing an annuity that offers extra features or benefits. You buy an annuity with a lump sum and can use double or triple the premium amount as your long-term-care.

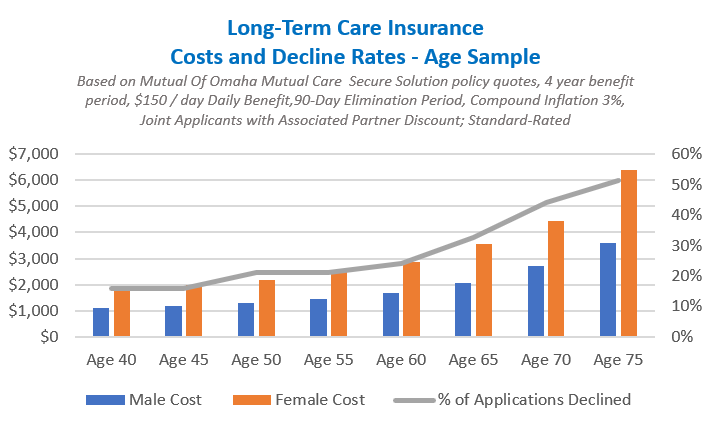

Morbi accumsan ipsum velit. This type of hybrid annuity is designed to prevent destruction of your retirement savings should you require long term care or home health care services. You can tailor a Mutual of Omaha long-term care insurance policy using a mix of built-in benefits and optional benefit riders.

Long Term Care Annuities. There may be limitations such as the number of years of care that this benefit will cover. With the Global Atlantic ForeCare annuity you get all the benefits of a fixed annuity such as.

Long Term Care Annuities How do they work. Another option is to purchase an annuity contract that allows you to make large withdrawals from your initial premium if you need long-term care. So his initial long-term-care coverage maximum is 100000.