Non Qualified Annuity Tax Rules

When you make withdrawals or begin taking regular payments.

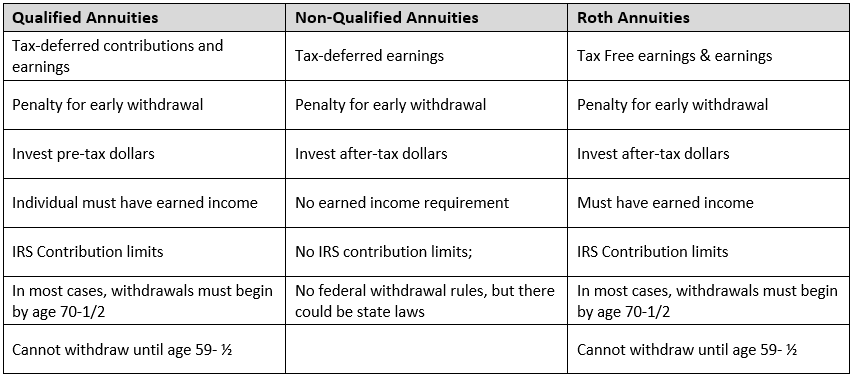

Non qualified annuity tax rules. A non-qualified annuity is not part of an employer provided retirement program and may be purchased by any individual or entity. Non-qualified annuities require tax payments on only the earnings. You dont pay taxes on the principal amount you used to purchase the annuity since that was after-tax money.

A non-qualified annuity means that youll receive no tax deduction up front for your contributions to the annuity but you also wont pay taxes when withdrawing your original funds. The amount of taxes on non-qualified annuities is determined by something called the exclusion ratio. This means any earnings on the investment are not taxed until they are paid out to the annuity holder.

Unlike the IRS. Nonqualified annuities those not established. Rules governing life insurance contracts the tax rules for non-qualified annuities are still somewhat complicated.

All annuities are allowed to grow tax-deferred. A qualified transfer can be more complicated than a non-qualified transfer if. Here the regular annuity income tax rules apply.

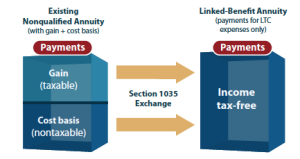

Tax deferral for annuity money. A non-qualified annuity on the other hand is funded using after-tax dollars. If you are a non-spousal beneficiary on an annuity contract there is a lesser known tax strategy that can significantly reduce the income tax you may pay if there is a built up gain in the policy.

Qualified and non-qualified annuities each follow a different set of tax rules for distributions. A non-qualified annuity is a product that you purchase outside of an employee benefit such as a 401 k. To be clear the terminology comes from the Internal Revenue Service IRS.