Periodic Payment Variable Annuities

These tax-free 1035 exchanges can be useful if another annuity has features that you prefer such as a larger death benefit different annuity payout options or a wider selection of.

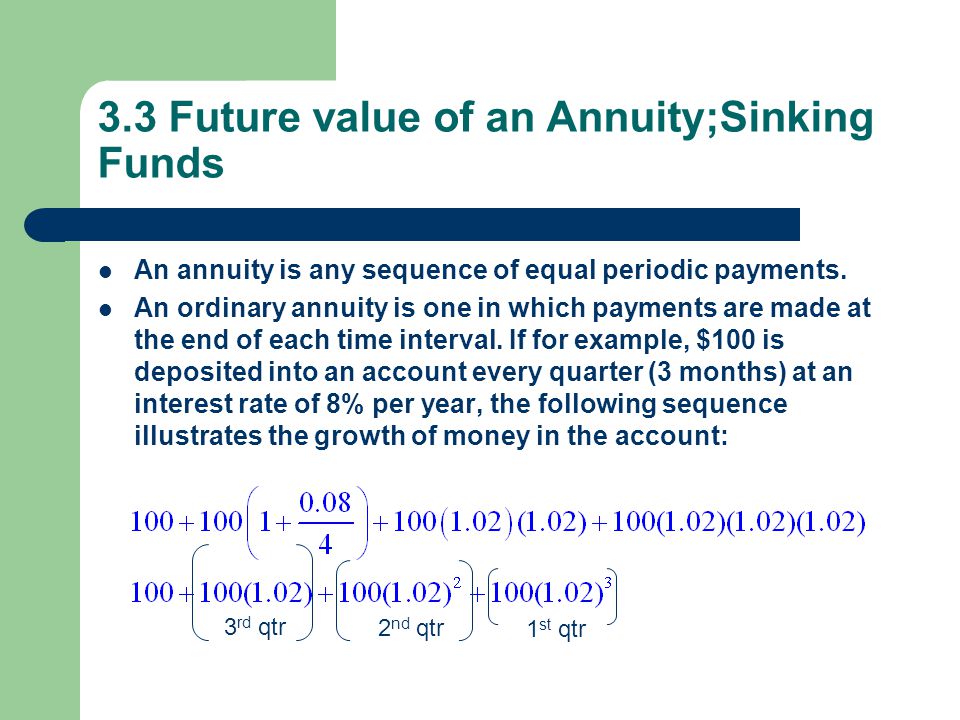

Periodic payment variable annuities. You purchase a variable annuity contract by making either a single purchase payment or a series of purchase payments. A variable annuity is a contract between you and an insurance company under which the insurer agrees to make periodic payments to you beginning either immediately or at some future date. An annuity is a financial contract that allows the buyer to make a lump-sum payment or a series of payments in exchange for receiving future periodic disbursements.

There are five main types of annuities. Other categories such as life and period certain describe how long payouts last. Annuities are insurance-based products that can be used to save for retirement in a tax-advantaged manner.

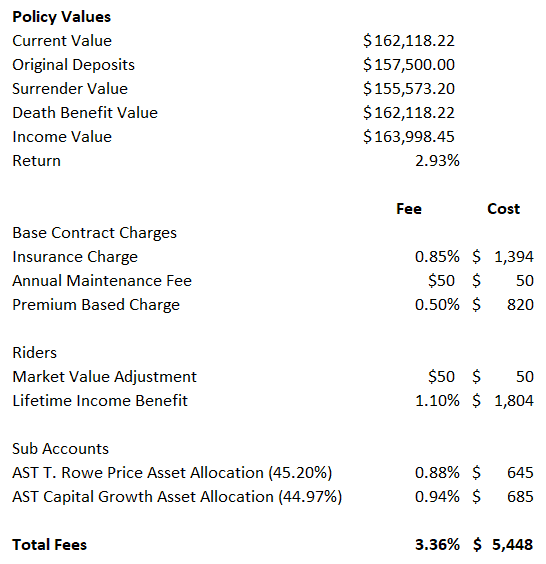

Periodic-Payment Deferred Annuity An annuitant makes gradual premium payments for this annuity contract until the annuitization date or date in which the annuity. The two phases in the life of an annuity are the accumulation phase and the annuitization phase or payout phase. Insurance companies use an assumed interest rate to calculate a variable annuitys periodic payments and its overall value.

It is very different than the traditional fixed annuity. Tax code allows you to exchange an existing variable annuity contract for a new annuity contract without paying any tax on the income and investment gains in your current variable annuity account. Fixed variable deferred immediate and indexed.

Third variable annuities let you receive periodic income payments for a specified period or the rest of your life or the life of your spouse. This process of turning your investment into a stream of periodic income payments is known as annuitization. A variable annuity is a contract between you and an insurance company under which the insurer agrees to make periodic payments to you beginning either immediately or at some future date.

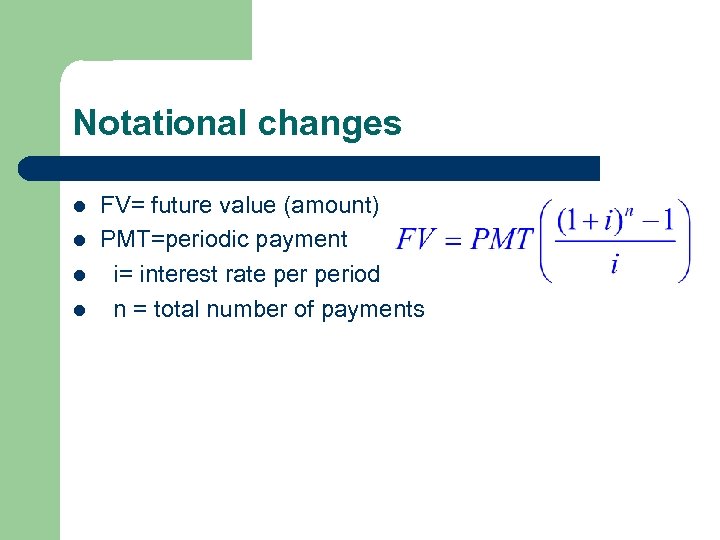

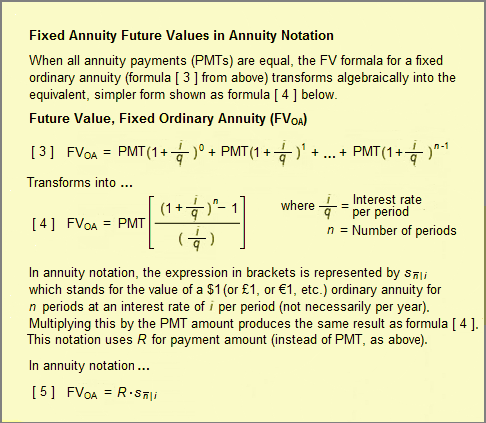

There are basically 2 types of annuities we have in the market. Annuity Payment is a series of payments at fixed intervals guaranteed for a fixed number of years or the lifetime of one or more individuals is calculated using annuity_payment Rate per Period Present Value1-1 Rate per Period-Number of PeriodsTo calculate Annuity Payment you need Rate per Period r Present Value PV and Number of Periods n. The present value portion of the formula is the initial payout with an example being the original payout on an amortized loan.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)