Usaa Annuity Rates

While one-third may never need long term care 20 percent will need it for longer than 5 years.

Usaa annuity rates. A MYGA provides compound growth at a fixed rate from anywhere between 3 and 10 years. The best MYGA rate is 27 percent for a 10-year surrender period 29 percent for a seven-year surrender period 3 percent for a five-year surrender period and 23 percent for a three-year surrender period. You can see our full list of MYGAs and their rates on the tables above.

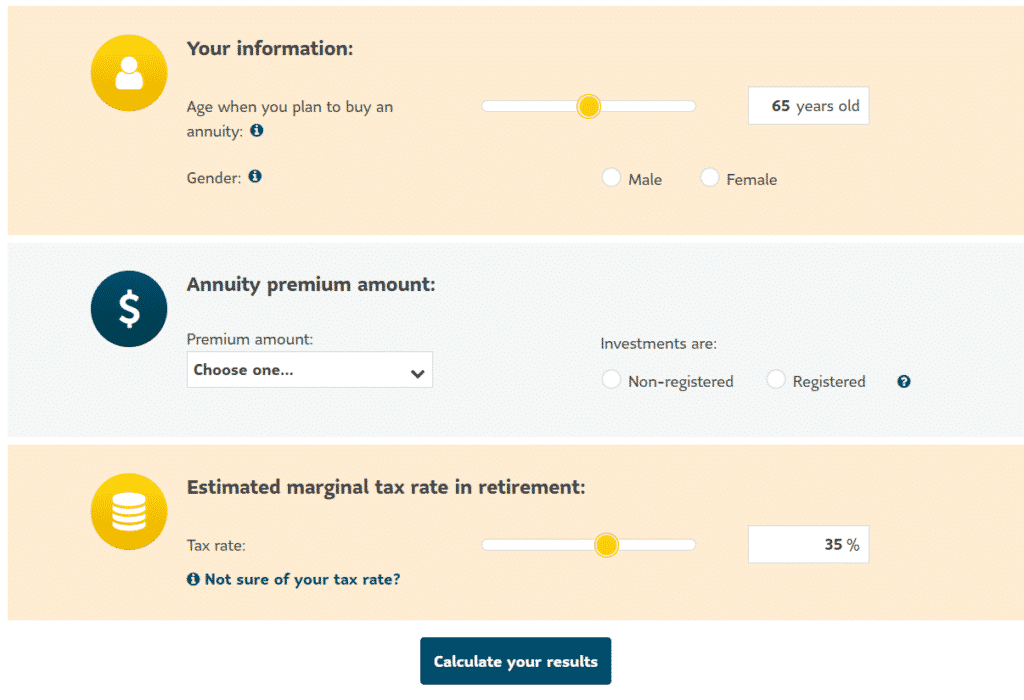

21045 n AGI 175000 n Tax rates 33 15 n Charitable intent n Cash in annuity assets n Offset gain with interest or contingent. Guaranteed for 3 years. 3 to 7 APR rate history.

41045 n Total gain. If you opened your annuity. Annuities can be particularly helpful to Americans who are in or have been in the military.

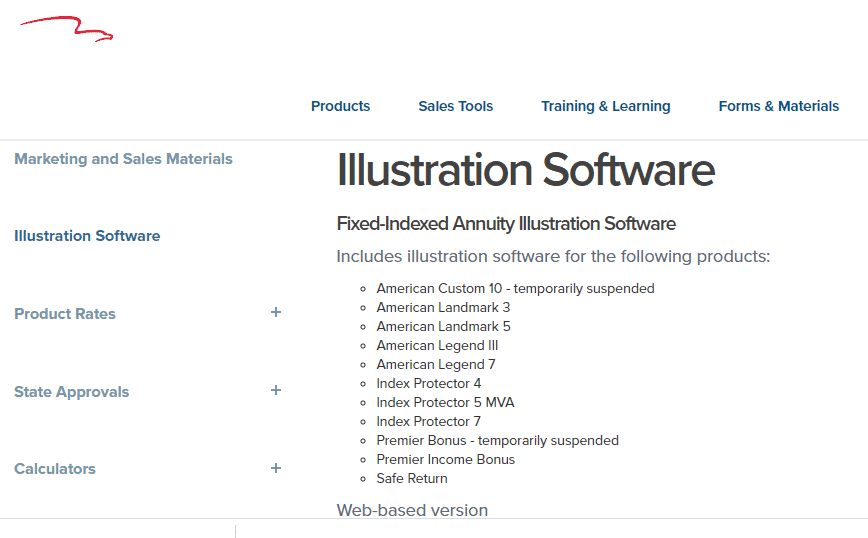

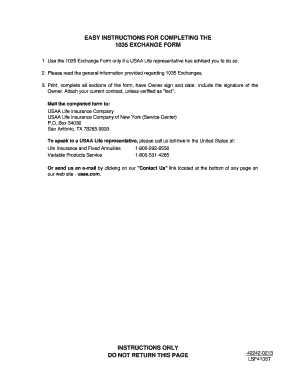

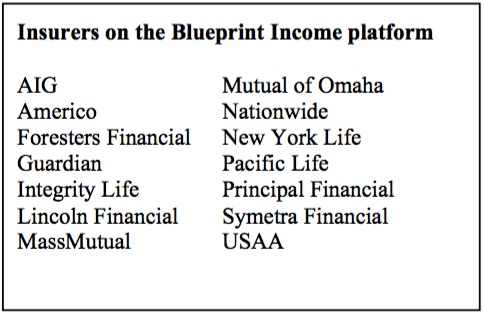

Annuities also can be fixed or variable. Life insurance and annuities provided by USAA Life Insurance Company San Antonio TX and in New York by USAA Life Insurance Company of New York Highland Falls NY. The USAA Offers Annuity Basics.

2 years ago then you will be charged a 8 fee on the 2000 or 160. The average length of time people need long term care services is 3 years. Predictable 4-12 APO Retirement Income LOW or NO ANNUAL FEES.

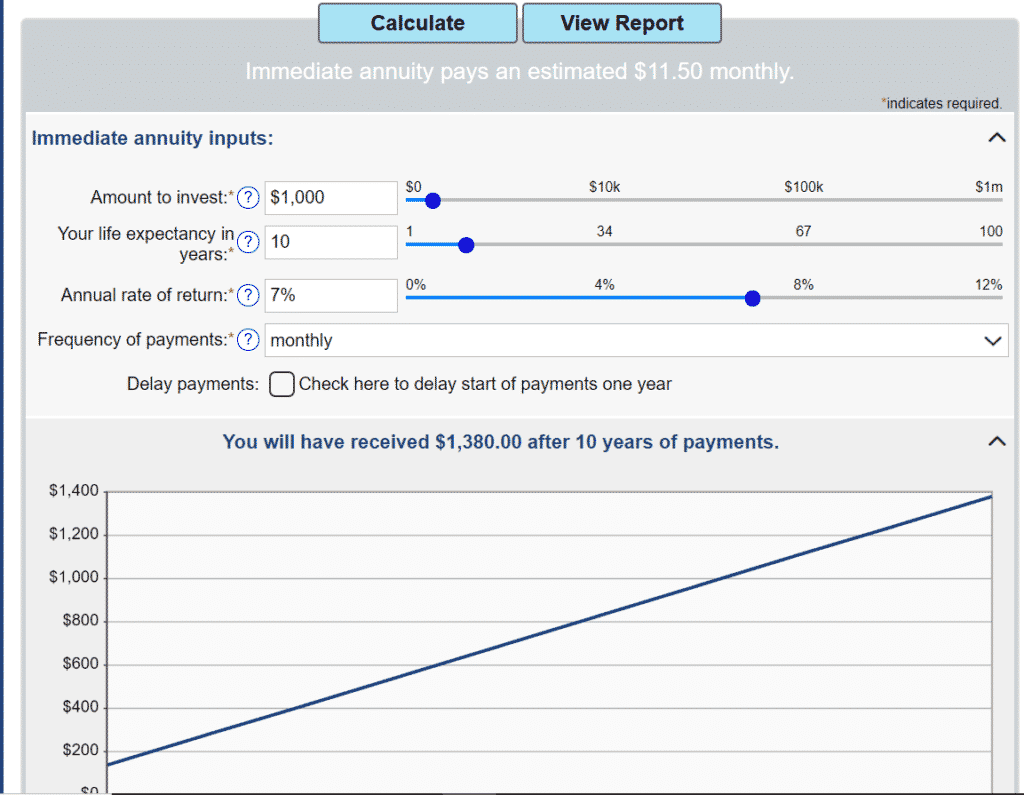

USAA Life Insurance Company and USAA Life Insurance Company of New York. An annuity might have a 40 payout rate after a 7 year deferral but go up to a 46 payout rate after 10 years. For example your annuity has 100000 and you withdraw 12 then you will need to pay an extra charge on the 2 or 2000.