Variable Annuity Taxation

Tax code allows you to exchange an existing variable annuity contract for a new annuity contract without paying any tax on the income and investment gains in your current variable annuity account.

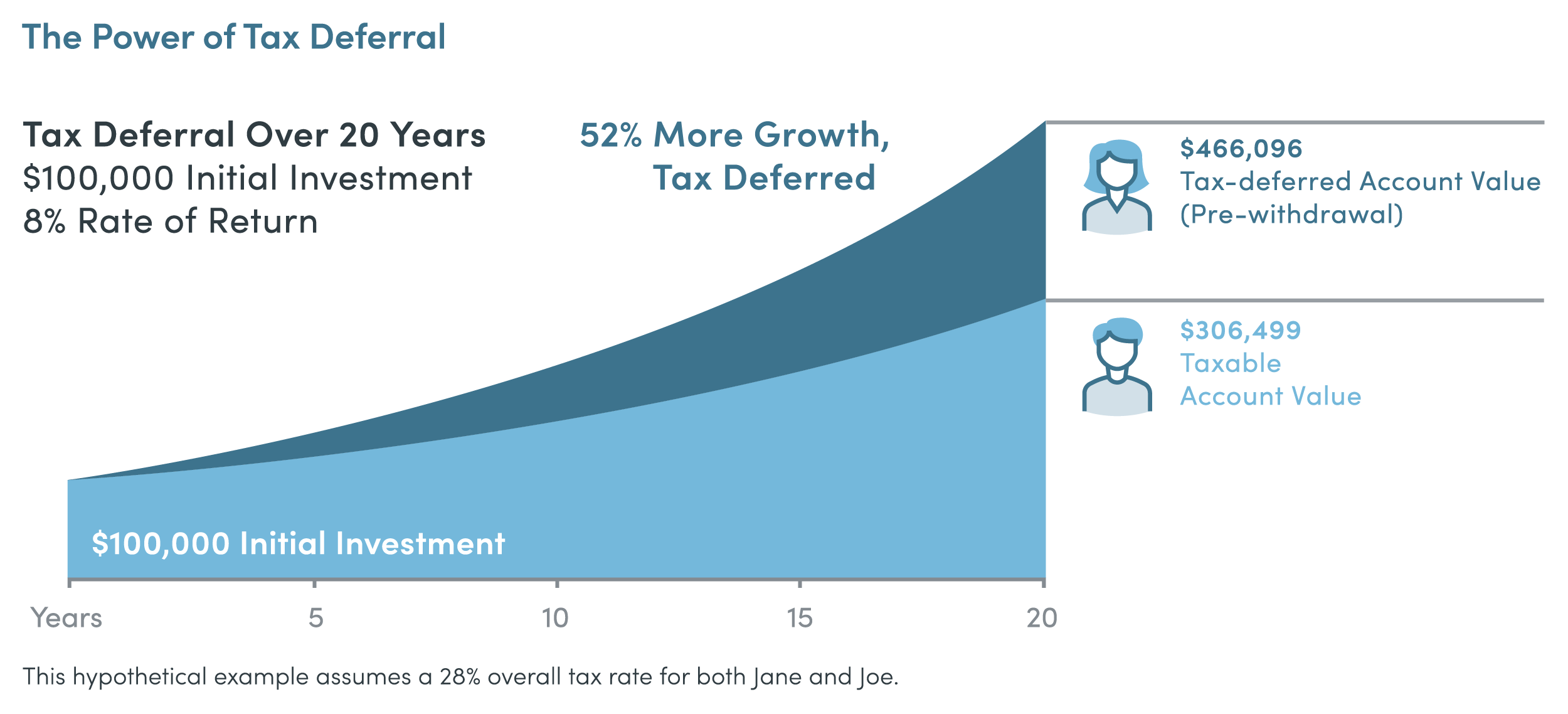

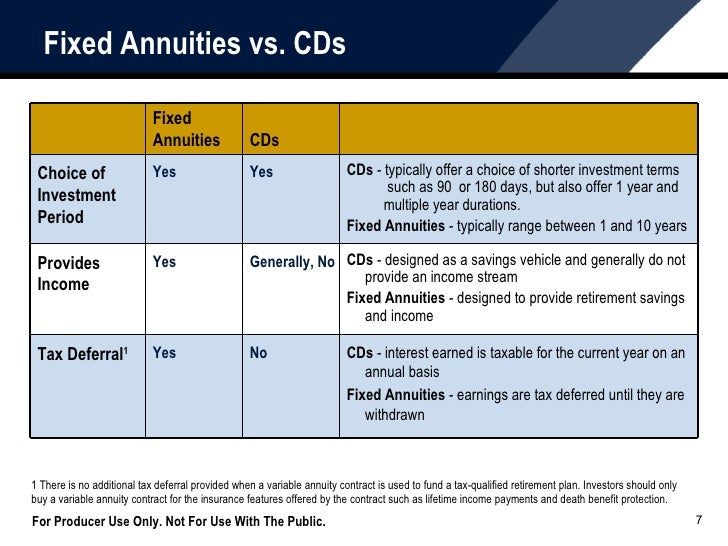

Variable annuity taxation. An investor in variable annuities is not taxed on the income and investment gains from his annuity until money is withdrawn. Both are taxed at ordinary income rates. If you purchase an annuity with pre-tax dollars payments from the annuity are fully taxable as income.

At that point the money you receive. Taxes follow some simple rules while the non-qualified variable annuity is accumulating money. A variable annuity is a tax-deferred insurance product that combines investing and standard annuity benefits.

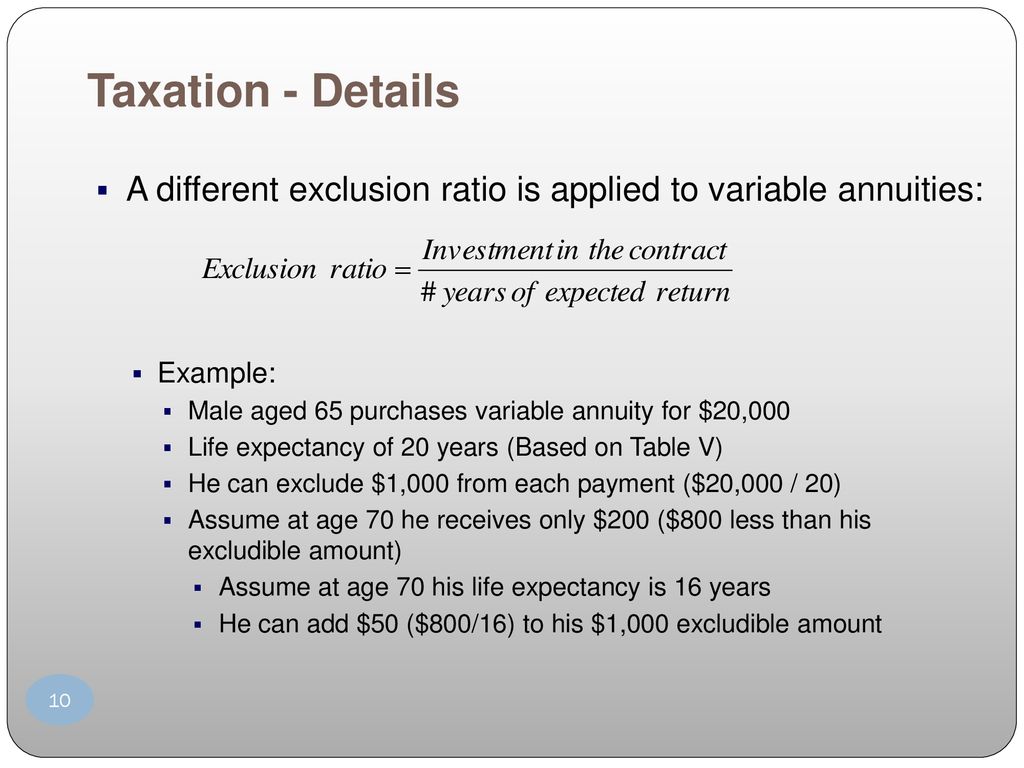

All distributions are taxed at ordinary income rates. Variable annuity contracts are sold as investment vehicles that can offer significant tax savings by deferring income taxes on any gains. It allows for growth in the contract to be deferred from taxation and it provides a mechanism to prorate taxation of the gain as its paid out.

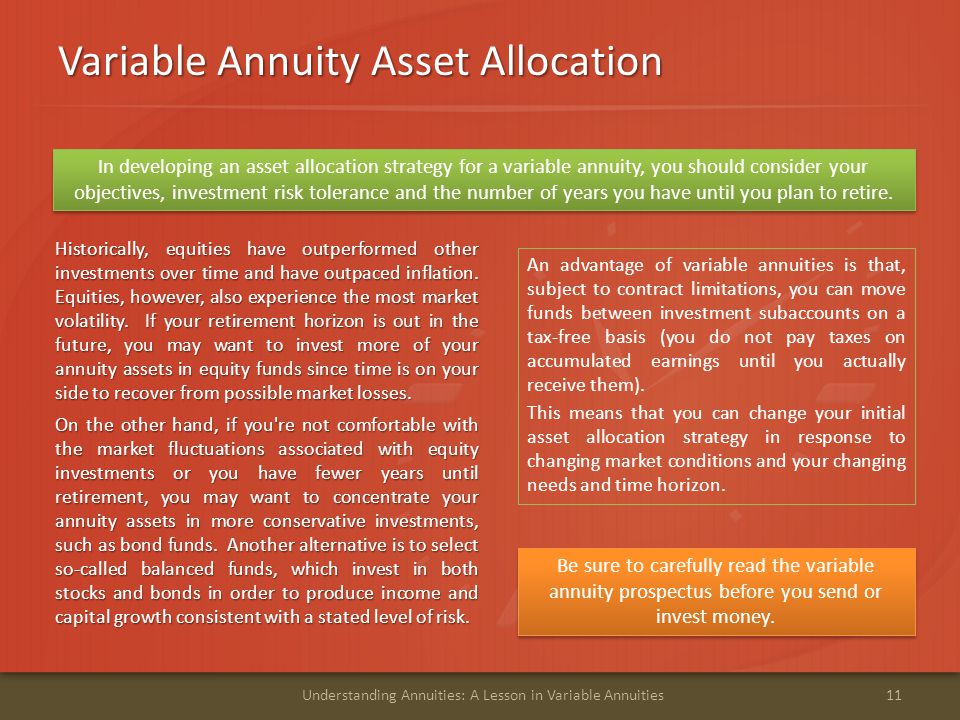

Annuities are not eligible for capital gains tax treatment. The earnings in your variable annuity account become taxable only when you withdraw money or receive income from the insurer in the payout phase of the annuity. Money can also be transferred throughout different investment options within a single variable annuity account without being taxed at.

However as with other types of tax-deferred investments you do have to pay taxes when you make withdrawals and your age has an impact on the amount of tax you pay when you make withdrawals. Variable annuities are tax-deferred vehicles which mean under current tax laws any guaranteed interest rate or gain in an annuity is not taxable until you begin to actually receive this income. Modeling taxation of Variable Annuities has been frequently neglected but accounting for it can significantly improve the explanation of the withdrawal dynamics and lead to a better modeling of the financial cost of these insurance products.

For instance if one of the investment options in your 403b plan is a variable annuity when you defer salary to contribute to the annuity within that plan those deferrals will reduce your taxable income and when you take money out of the plan it will be taxable. In addition if you are investing in a variable annuity through a tax-advantaged retirement plan such as a 401k plan or an IRA you will get no additional tax advantage from the variable annuity. Annuities are not eligible for capital gains treatment.