Variable Annuity Vs Mutual Fund

Mutual funds may be purchased from the fund company directly or through a.

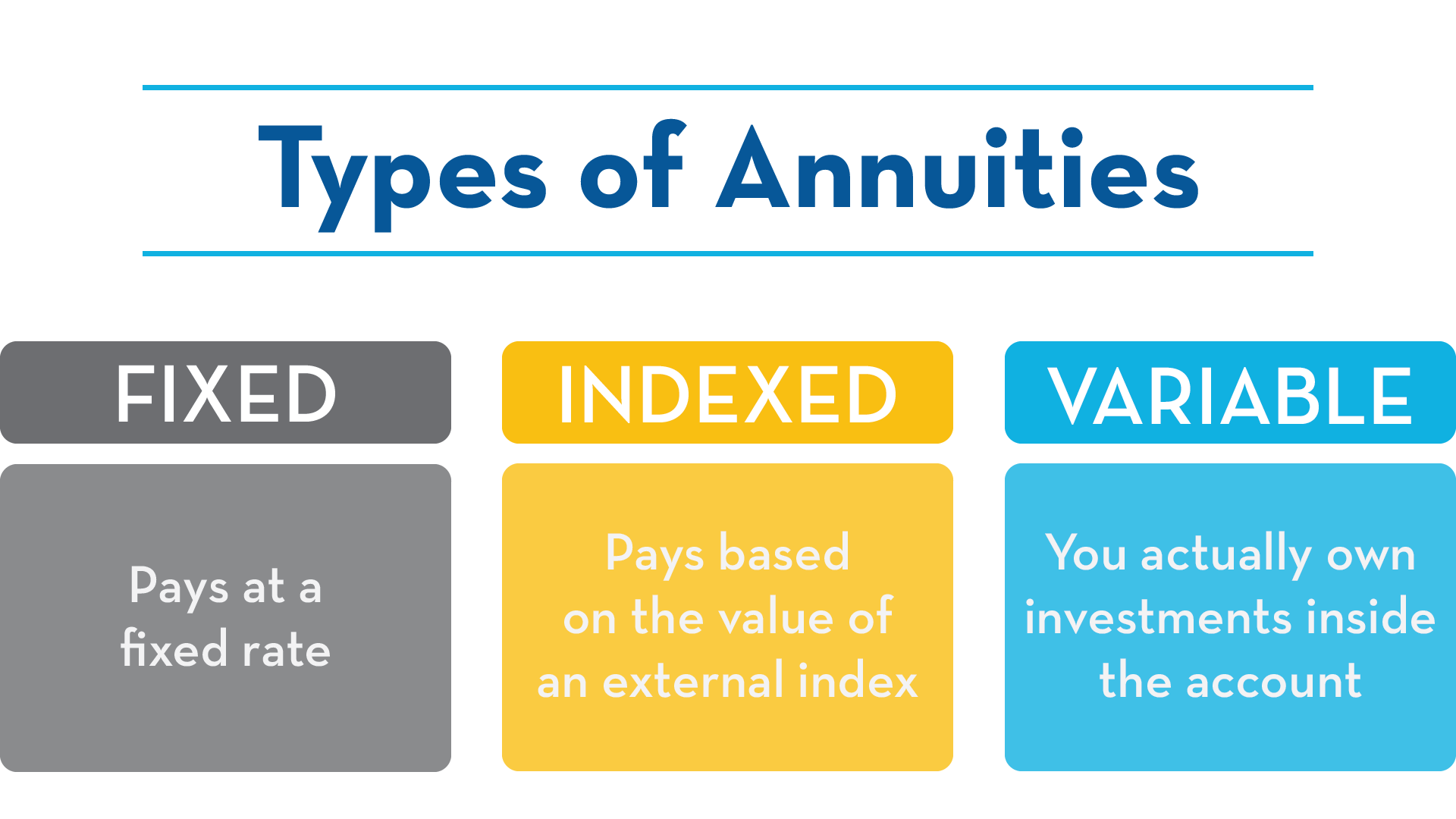

Variable annuity vs mutual fund. Regardless of whether your annuity is qualified or non-qualified the insurance company will be the account custodian. Its also important to note that annuities are not investment securities. Variable annuities typically have more of them because of the insurance features.

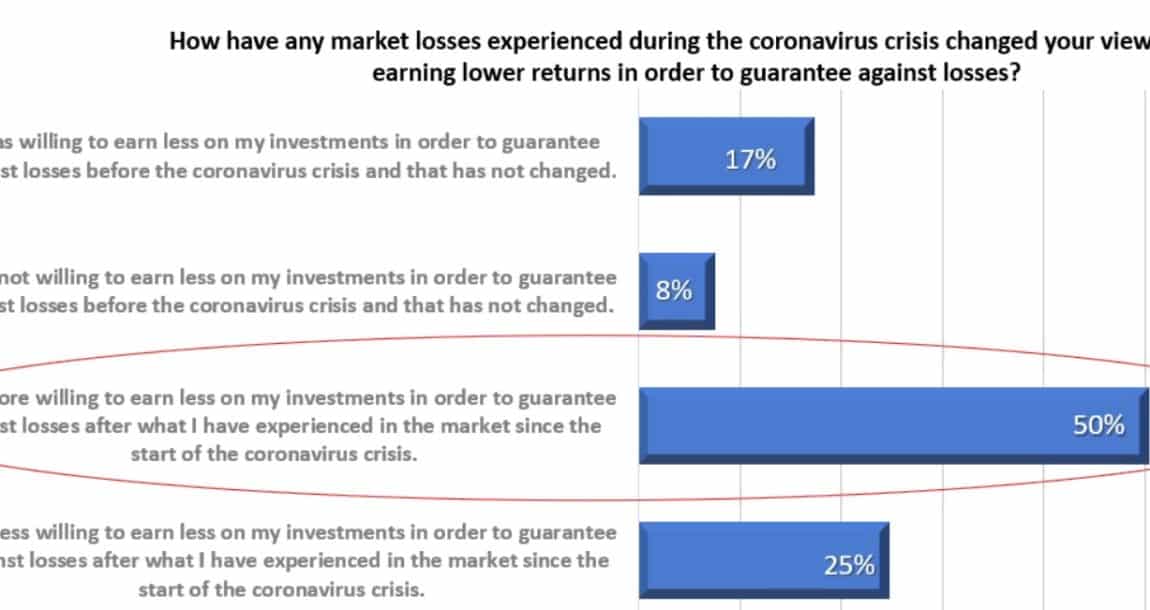

Mutual funds consist of a collection of different investments sold in shares and purchased by large numbers of individuals. Variable annuity mutual funds and mutual funds are cousins not identical twins. While the fees of an annuity may be 1 higher than those of mutual funds it seems that this would be offset by the tax deferral advantages.

A variable annuity is basically a mutual fund inside a tax-deferred insurance wrapper. Variable annuities are purchased directly from life insurance companies. Those payments can be set up for the rest of your life or for the life of your spouse using something called an income rider.

The investments are not tax-deductible since usually variable annuities are sold outside tax-deferred accounts as they already have a tax-deferred component. One significant difference between mutual funds and variable annuities is the account custodian. In fact variable annuities offer a menu of investments that look just like mutual funds called subaccount funds.

They are insurance products. If the company is not in Phase II there would be no tax at all. There are equal number of pros and cons of variable annuities if you compare them with mutual funds.

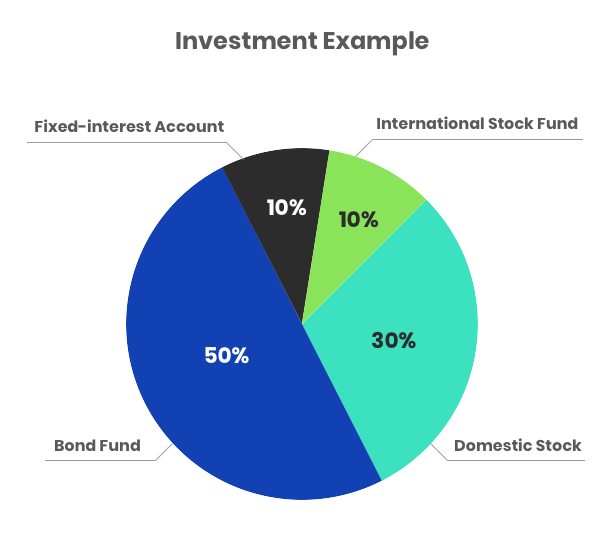

Its a pooling of money to achieve diversification. Investments are made in mutual funds or mutual-fund-type accounts offered by the particular annuity. If it is in Phase II the tax would be at essentially a rate of 25 per cent.