Annuity Cost Basis

The amount of taxable income you report from selling an annuity is figured by subtracting your cost basis from the sale proceeds.

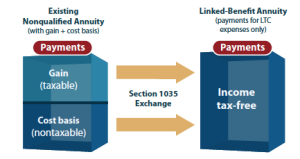

Annuity cost basis. If the annuity owner receives a lump sum distribution at a value below their cost basis they may be able to claim the loss on their federal tax return if they itemize. Those types of transactions can impact your cost basis. Non-qualified means it is not part of a qualified employee retirement plan.

Are you wondering what is a cost basis on an annuity. The cost basis is the principal amount of your annuity the original purchase price of your contract either as a lump sum or as regular premium payments. In the world of investments your cost basis is the amount you paid.

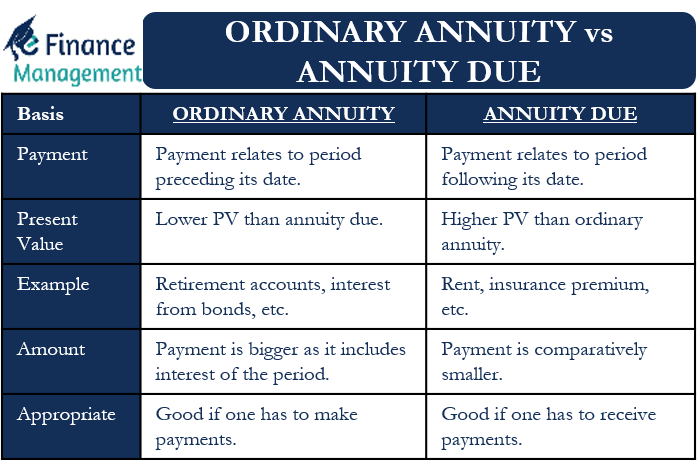

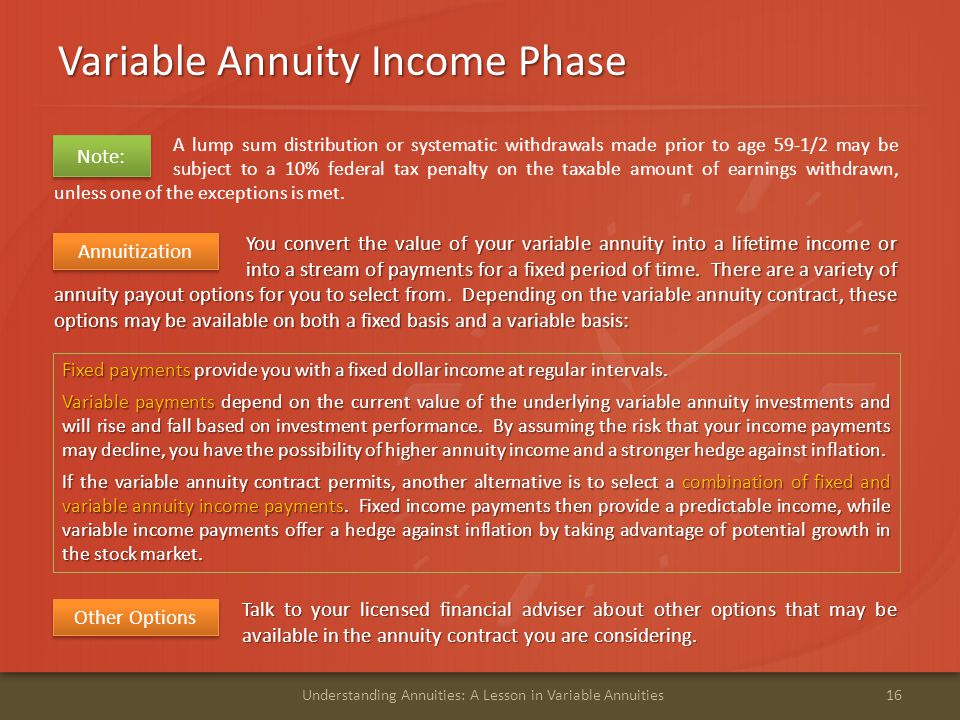

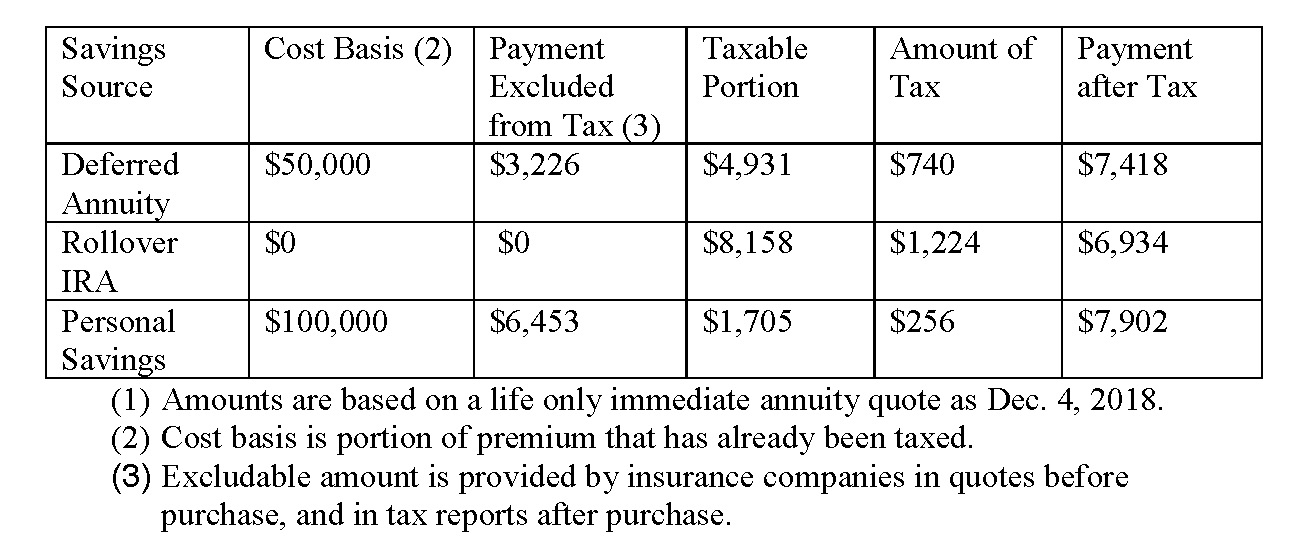

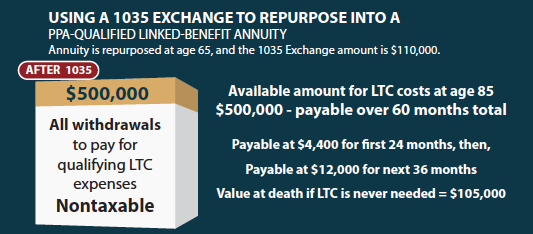

This value is used to determine the capital gain which is equal to the difference. For periodic annuity payments from non-qualified annuity contracts your cost basis is allocated over the anticipated total annuity payments using IRS-approved actuarial life expectancy tables. Surrender charges assessed to the annuity owner following a withdrawal or surrender will not qualify as a loss under this ruling.

Your initial paymentpremium s paid to a nonqualified annuity is known as the cost basis in your contract. So for example if a life insurance contract with a cost basis of 30000 a. This covers all inherited assetsannuity mutual funds real estate and sharesstocks.

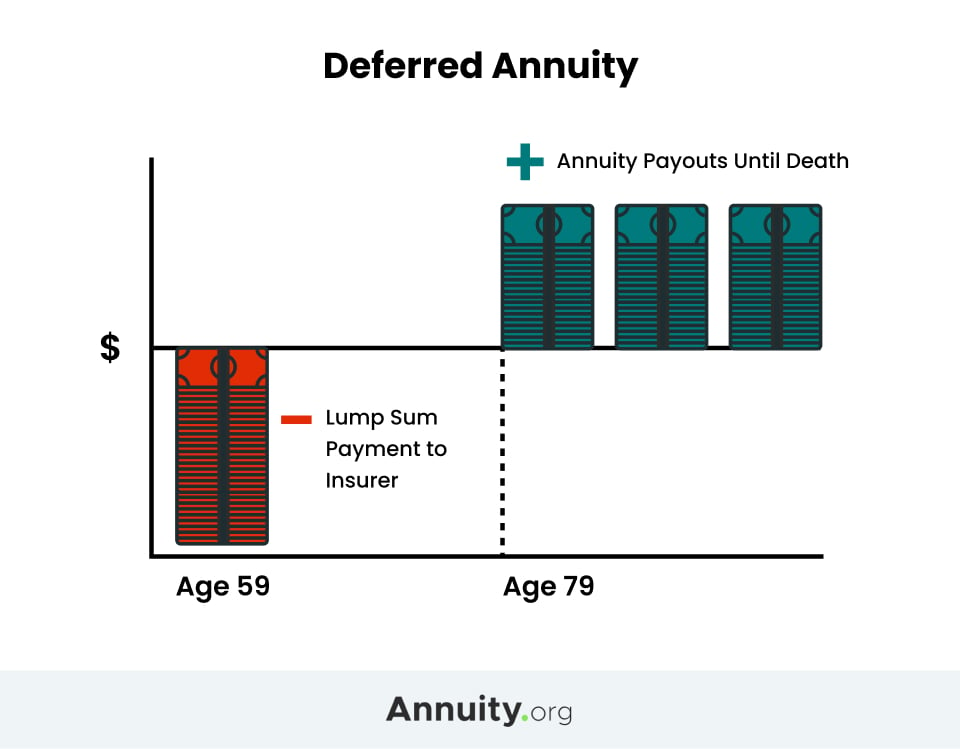

Herein what is cost basis in annuity. Take for example a deferred annuity that was purchased for 100000 and is now worth 200000. Classification of the Annuitys Owner as a Trust.

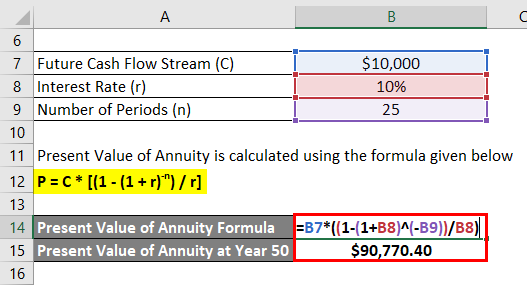

The average cost basis method is commonly used by investors for mutual fund tax reportingA cost basis method is reported with the brokerage firm where your assets are held. Pre-TEFRA cost basis is cost basis established before August 14 1982. Annuity Transactions with the Income Tax and Cost Basis Results are Itemized Below Settlement option on an existing deferred annuity or the purchase of a new SPIA Determine the exclusion ratio based on the cost basis investment in the contract and the expected return.