Non Qualified Variable Annuity

You can move as much of.

Non qualified variable annuity. This means any earnings on the investment are not taxed until they are paid out to the annuity holder. A non-qualified annuity is funded with post-tax dollars. Your contributions are not tax-deductible.

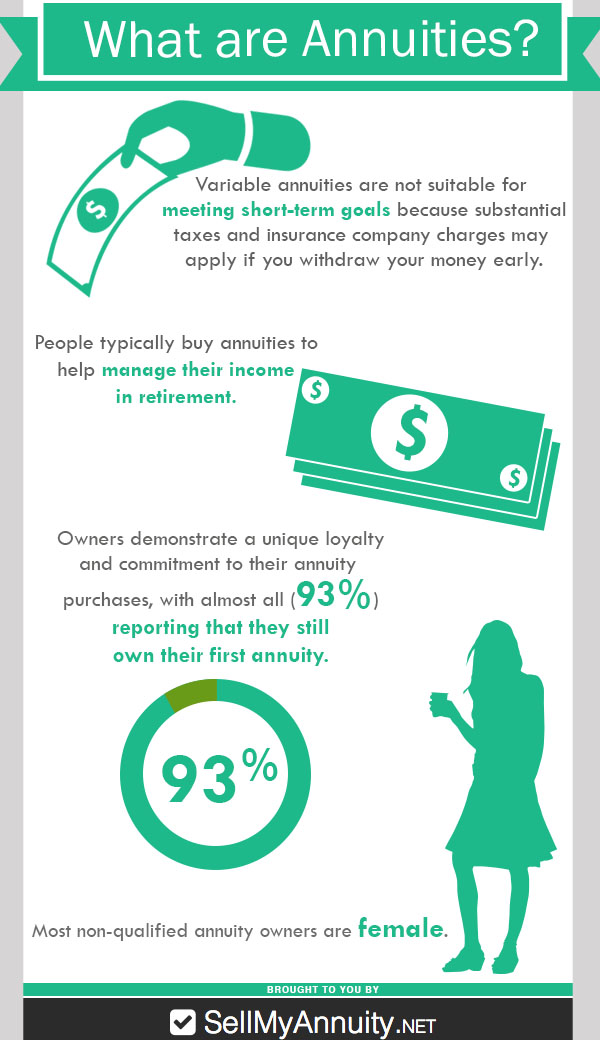

A non-qualified annuity is a product that you purchase outside of an employee benefit such as a 401 k. Heres a rundown of the benefits non-qualified annuities could offer. Whether you should purchase qualified or non-qualified annuities depends on your tax situation retirement needs and financial goals.

Nonqualified variable annuities are tax-deferred investment vehicles with a unique tax structure. Technically you can liquidate a non-qualified annuity but it will cost you. As long as your money remains invested in the annuity.

Box 2378 For Non-Qualified and IRA contracts we withhold a minimum federal amount of 10 and forward applicable taxes to the Internal Revenue. If they live longer than their calculated life expectancy all annuity payments beyond that time period are taxed as income. The difference is generally subject to ordinary income tax and may be subject to an additional 10 tax penalty if.

The income on variable annuities is susceptible to. You still earn tax-deferred investment returns and pay no tax on the portion of. Non-qualified variable annuities are personally owned and paid for with after-tax dollars.

Purchasing a non-qualified variable annuity can also provide an additional retirement savings advantage for an investor who has already contributed the maximum dollar amount allowed to a qualified plan. In contrast earnings that have been taxed such as the money you have in your checking or savings accounts is regarded as non-qualified. In recent years variable annuity providers have developed new contracts for those primarily interested in.